Money management rules can make the difference between barely getting by and flourishing in today’s economy. Recent studies show that 58% of Europeans worry about rising prices, while seven in ten people in the UK list price increases as their biggest concern. The need to manage money wisely has never been more significant.

Strong financial habits do more than ease your worries—they help build wealth steadily. Wealthy people stick to specific money principles that create lasting security. The 50/30/20 rule suggests you should use 50% of your income for needs, 30% for savings and investments, and 20% to improve your lifestyle. The 10/20 rule recommends saving 10 times your monthly expenses for emergencies and working toward 20 times your yearly salary to retire comfortably.

Financial success doesn’t come from luck or inheritance. It stems from discipline and following proven money rules. The top 1% understand that staying invested matters more than market timing. This piece reveals 15 most important personal finance rules that wealthy people always follow, helping you build financial stability whatever the economic climate.

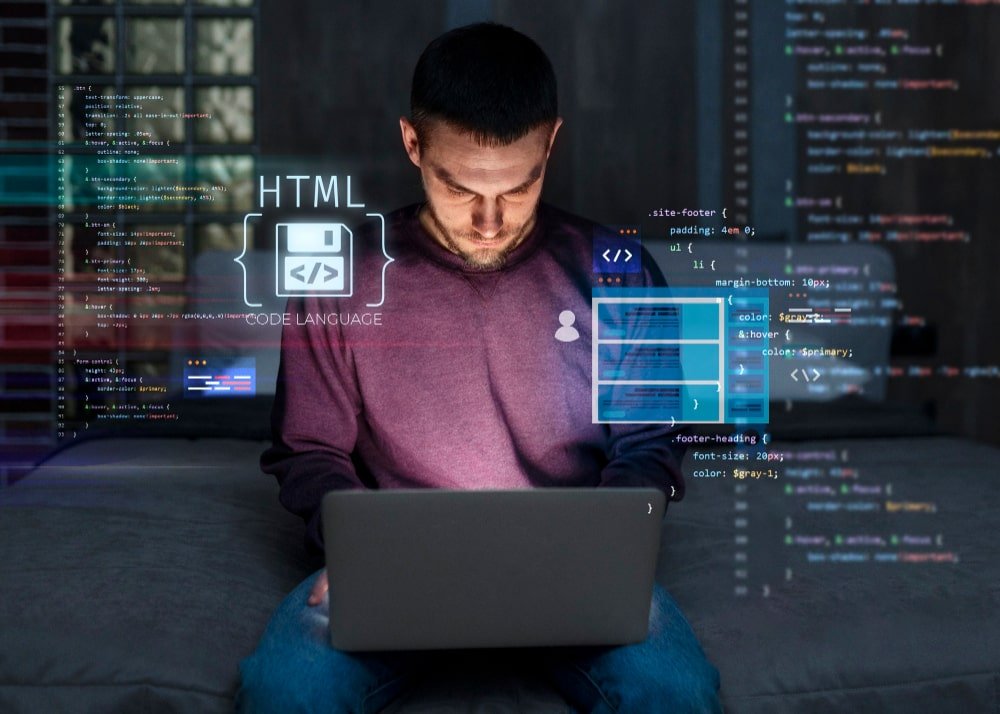

Rule 1: Always Pay Off Your Credit Card

Image Source: Self Credit Builder

Credit card debt can turn into a financial nightmare if you don’t manage it well. The first rule of personal finance tells you to pay off your credit card balance in full each month. This simple rule sets apart people who are good with money from those who struggle with debt.

Explanation of Always Paying Off Credit Card

You won’t face any interest charges if you pay your credit card balance in full before the due date. Credit card companies usually charge an annual percentage rate (APR) between 16% and 25% on carried balances. Your debt grows faster because most credit card interest compounds daily – you pay interest on top of interest. The golden rule is simple: only charge what you can afford to pay off each month to avoid falling into this debt trap.

Why Top 1% Follow This Rule

Rich people know there’s no point in carrying credit card balances. Financial advisors say their wealthy clients pay off their card balances in full almost always. On top of that, it helps build a better credit score when you show you can borrow responsibly.

A zero balance keeps your credit utilization ratio low, which heavily influences your credit score. Lenders like to see a debt-to-credit ratio at or below 30%. People with the highest credit scores typically keep their ratios in low single digits. This smart practice leads to better loan terms and financial opportunities.

How to Apply This Rule

Here’s the quickest way to follow this basic finance rule:

- Put extra money toward your balance—every dollar cuts down your principal

- Set up automatic payments so you never miss a due date

- Watch your spending to avoid charging more than you can pay

- Look into balance transfer options or debt consolidation loans with lower rates if you’re already in debt

- Use either the snowball method (tackle smallest balances first) or avalanche method (target highest interest rates first) if you have multiple cards

Sometimes you might not be able to pay in full due to money being tight. In that case, pay as much as you can above the minimum to reduce interest costs and get out of debt sooner.

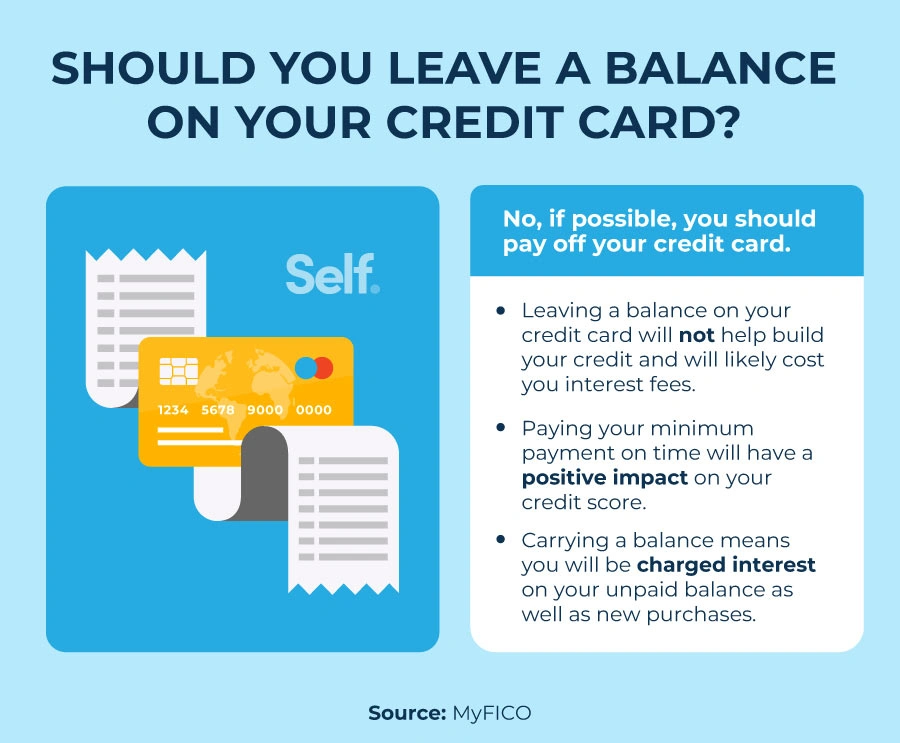

Rule 2: Spend Within Your Means

Image Source: Albert

Living beyond your means can trap you in debt and stress. Personal finance rule #2 teaches a simple yet powerful idea – spend less than you earn.

Explanation of Spending Within Means

Your expenses should stay below or match your income. This basic principle builds the foundation of financial success. A Federal Reserve study showed that 44% of adults couldn’t cover a $400 emergency expense without borrowing money or selling something. Living within your means helps you cover expenses and set aside money for savings and investments. This creates a safety net against emergencies and helps you build wealth as time passes.

Why Top 1% Follow This Rule

The wealthy stick to this principle even with their vast resources. Billionaires watch their spending closely and make each dollar count. The top 1% know that careful spending lets them put more money into wealth-building chances. They choose quality over quantity and buy items with lasting value instead of quick satisfaction. They also understand that lifestyle inflation can eat away wealth and block financial goals.

How to Apply This Rule

Here’s how you can use this key personal finance rule:

- Track your spending for a month to see where your money goes

- Create a budget that lists fixed expenses, variable costs, and savings goals

- Identify wants versus needs to cut spending and focus on necessities

- Leave credit cards at home and buy only what you can afford with cash or debit

- Save for large purchases rather than using credit

Living within your means gives you several benefits:

- Freedom to fix past money mistakes

- Knowing how to build an emergency fund

- A chance to invest and grow wealth

- A path to financial independence

The gap between your earnings and spending determines your financial success. The wider this gap grows, the more wealth you can build.

Rule 3: Pay Yourself First

Image Source: Home Credit

The fundamental rule of personal finance turns traditional budgeting upside down. Paying yourself first prioritizes savings before expenses and serves as the foundation of wealth building for financially successful people.

Explanation of Paying Yourself First

“Pay yourself first” puts your financial future ahead of current expenses. This strategy requires you to automatically save or invest part of your income before paying bills or making purchases. Your future financial security takes precedence over regular expenses, making savings non-negotiable.

Financial experts suggest saving 10% to 20% of your income through this method. This approach succeeds because you learn to live on what remains after saving. Your wealth grows automatically. Some experts call this “reverse budgeting” since savings take priority over expenses.

Why Top 1% Follow This Rule

Wealthy people know this rule creates lasting financial security. The strategy helps curb lifestyle creep—your natural tendency to spend more as you earn more. Money tucked away in savings accounts stays safe from impulse purchases.

On top of that, early adoption of this rule maximizes compound interest—the interest earned on previously earned interest. The top 1% understand a simple truth: longer investment periods lead to dramatic growth.

This approach builds a consistent savings habit that grows stronger each year. High earners consider this rule crucial—they typically save 20%-30% of their income and treat these savings as mandatory expenses.

How to Apply This Rule

The rule works best when you:

- Set clear goals – Choose specific targets: emergency fund, retirement, or other financial objectives

- Automate the process – Schedule automatic transfers from checking to savings accounts on payday

- Start small if necessary – Begin with manageable amounts and increase your savings percentage gradually

- Track your progress – Check your savings every six months and adjust as your income grows

This finance rule succeeds because it demands minimal effort compared to detailed budgeting. Your future self becomes the priority, and wealth builds steadily without constant attention.

Rule 4: Invest Consistently

Image Source: TrueData

The life-blood of personal finance that wealthy people never skip is consistent investing. This practice builds wealth steadily, and it becomes even more valuable during market volatility when emotions can drive losses.

Explanation of Consistent Investing

Consistent investing means putting money into investments regularly, whatever the market conditions might be. This strategy, known as dollar-cost averaging, involves fixed investment amounts at set intervals instead of trying to time the market. The approach lets you buy more shares when prices fall and fewer when they rise, which can lower your average cost per share.

This financial principle works because market timing is nowhere near possible, even for professional investors. A study revealed that small, periodic investments in the S&P 500 since 2000 would have produced excellent gains despite wars, pandemics, and financial crises.

Why Top 1% Follow This Rule

Financial elites know that disciplined, regular investing performs better than occasional contributions. These wealthy individuals keep about 78% of their retirement portfolios in stocks to maximize growth potential.

The wealthy have learned that consistent investing:

- Takes emotion out of investment decisions

- Builds a disciplined investing mindset

- Keeps investments intact during market downturns

- Makes compounding more powerful over time

Peter Lynch, the legendary investor, emphasized that evaluating investments based on future potential rather than past performance is vital. Consistent investing helps wealthy people avoid the “get in, get out” mindset that typically results in lower returns.

How to Apply This Rule

Here’s how to implement this significant financial rule:

- Start immediately – No perfect moment exists to begin

- Automate your investments – Link transfers to your payday

- Increase contributions annually – Small increases add up dramatically over time

- Stay disciplined during downturns – Market drops offer chances to buy “on sale”

Want a website that’s fast, beautiful, and built to rank? At Mehnav, we create modern, secure websites that Google loves — lightning-fast, mobile-friendly, and SEO-optimized. We also make explainer videos to boost your brand and help you rank on Google, ChatGPT, and AI search results. Let’s build your success online — Contact Mehnav — only a few slots left this month!

Note that many millionaires consider this finance rule non-negotiable. They set up automatic transfers from checking to investment accounts and treat investing like a fixed expense. A simple USD 200 invested biweekly for 20 years with a 6% annual return could grow beyond USD 197,000. Adding just USD 20 more each year could result in USD 347,000.

Rule 5: Avoid Lifestyle Inflation

Image Source: Investopedia

Lifestyle inflation quietly chips away at your financial progress as your spending automatically increases with your income. This personal finance rule demands disciplined spending habits even when your bank account can handle more.

Explanation of Lifestyle Inflation

Your spending patterns tend to match or exceed your rising income. Major career milestones like graduation, promotions, or pay raises often trigger this behavior. The extra money you earn doesn’t feel like much because you’ve already spent it all. Luxuries such as fancy restaurant meals or premium accommodations slowly become things you can’t live without. You might find yourself earning way more money but still struggling between paychecks.

Why Top 1% Follow This Rule

Wealthy people know that unchecked lifestyle inflation stands in the way of reaching key financial goals. Your ability to save and invest takes a hit when additional income gets eaten up by spending. Higher monthly bills also limit your options during emergencies or opportunities. The top 1% realize that lifestyle inflation pushes important milestones further away – buying a home, starting a business, or retiring comfortably. They’ve mastered the difference between smart upgrades and mindless spending.

How to Apply This Rule

This vital personal finance rule needs careful implementation:

- Make small changes to your lifestyle after income bumps, rather than big upgrades

- Set up automatic savings right after raises so investment comes before spending

- Build spending boundaries by setting clear money goals that keep overspending in check

- Pick experiences over things to celebrate success since they bring lasting joy

- Think before buying by questioning if purchases match your values and long-term plans

Our team at Mehnav helps clients build websites that grow businesses while sharing financial wisdom through content. Keep in mind that avoiding lifestyle inflation doesn’t mean never improving your life—it means making thoughtful choices while growing your savings. The Mehnav team suggests focusing on what truly matters while cutting back elsewhere.

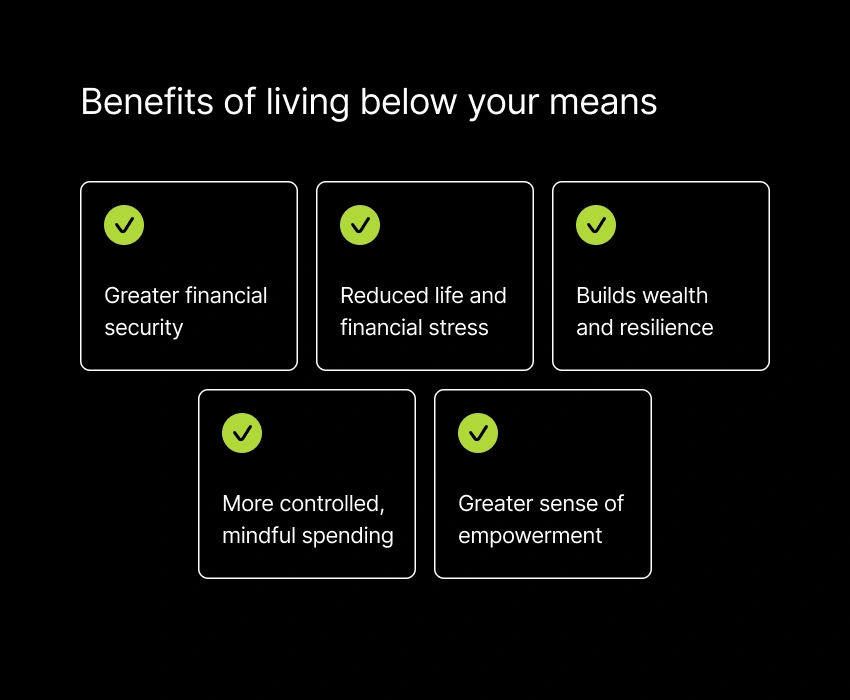

Rule 6: Build an Emergency Fund

Image Source: YouTube

Life throws unexpected challenges your way, and an emergency fund acts as your financial safety net. Rule 6 of personal finance rules shows you how to build this critical buffer against financial hardship.

Explanation of Emergency Fund

Your emergency fund works as a separate savings account that you set aside for unforeseen situations like medical emergencies, car repairs, or job loss. This fund protects you against unexpected financial shocks, unlike regular savings for planned expenses. You should aim to save three to six months’ worth of living expenses. Studies reveal an interesting fact – having just $2,000 in emergency savings can benefit your financial well-being as much as owning $1 million in assets.

Why Top 1% Follow This Rule

The wealthy maintain emergency funds despite having substantial assets. These funds give them quick access to cash without forcing them to sell investments at bad times. On top of that, it helps them avoid high-interest debt during crises. These prominent individuals know they can’t predict emergencies, so they stay prepared.

How to Apply This Rule

Building an effective emergency fund requires you to:

- Begin with a modest goal of $500-$1,000, then build toward 3-6 months of expenses

- Store your funds in available accounts like high-yield savings or money market accounts

- Create automatic transfers on payday to build steadily

- Put windfalls like tax refunds toward faster progress

Mehnav helps clients build solid financial foundations through proper emergency planning. Note that your emergency fund should be readily available yet separate from daily spending accounts. Mehnav’s financial advisors emphasize that you should use this fund only for genuine emergencies and start rebuilding it right away.

Rule 7: Understand the Time-Money Tradeoff

Image Source: Weingarten Associates LLC

Time equals money in ways you might not realize. Rule 7 of personal finance rules explores this vital connection.

Explanation of Time-Money Tradeoff

Your time has monetary value. Americans value their time at an average of $240 per hour, which shows how valuable this resource is. This rule asks you to calculate your time’s true cost. Here’s a practical example: if you earn $1,000 weekly working 40 hours plus 10 hours commuting, your actual hourly value comes to $20. This knowledge helps you make better decisions about outsourcing tasks or doing them yourself.

Why Top 1% Follow This Rule

The wealthy know how to balance their time and money investments. They see that wealth gives them control over how they spend their time. 63% of Americans “feel wealthy” when they have enough time with family and friends. The top 1% know that paying for services often creates happiness. Studies show people who put time ahead of money report better well-being. People with higher incomes are more likely to value time over money compared to those earning less.

How to Apply This Rule

Here’s how you can use this rule in your life:

- Find your true hourly value by dividing take-home pay by total work-related hours

- Use this value to decide about outsourcing tasks

- Follow this simple rule: outsource tasks that cost less per hour than your hourly value

- Note that saved time lets you focus on personal growth, build stronger relationships, and improve your well-being

At Mehnav, we guide our clients through time and money decisions. Our Mehnav financial advisors believe that understanding this balance gives you the freedom to focus on life’s important aspects.

Rule 8: Don’t Invest in What You Don’t Understand

Image Source: X

Rule 8 of personal finance rules cautions against investing in things you can’t explain to a 10-year-old. This wisdom from Warren Buffett makes sense for everyone, not just billionaires.

Explanation of Investment Clarity

Investment clarity means you learn how your money works in investments. You should know what you’re buying, how it generates returns, and what risks you face. People often lose money because they chase trends without simple knowledge. Look at cryptocurrencies in 2021 – investors poured money without understanding blockchain technology and suffered huge losses when markets crashed.

Why Top 1% Follow This Rule

Rich people don’t gamble on investments they don’t understand. They know that understanding their investments creates confidence during market ups and downs. A lack of knowledge often pushes people to sell in panic when markets fall. The 1% do their research or get expert help before investing money. They make sure they grasp their investment’s basics.

How to Apply This Rule

Here’s how to use this important personal finance rule:

- Choose simple investments like index funds

- Read an investing book each month

- Test yourself: “Can I explain this investment to others?”

- Stay away from investments pushed through fear or FOMO

Mehnav helps clients build their knowledge as they grow their wealth. Our Mehnav advisors suggest starting with familiar investments before expanding your portfolio. We focus on teaching you first, then helping you invest, so your money works without taking unnecessary risks.

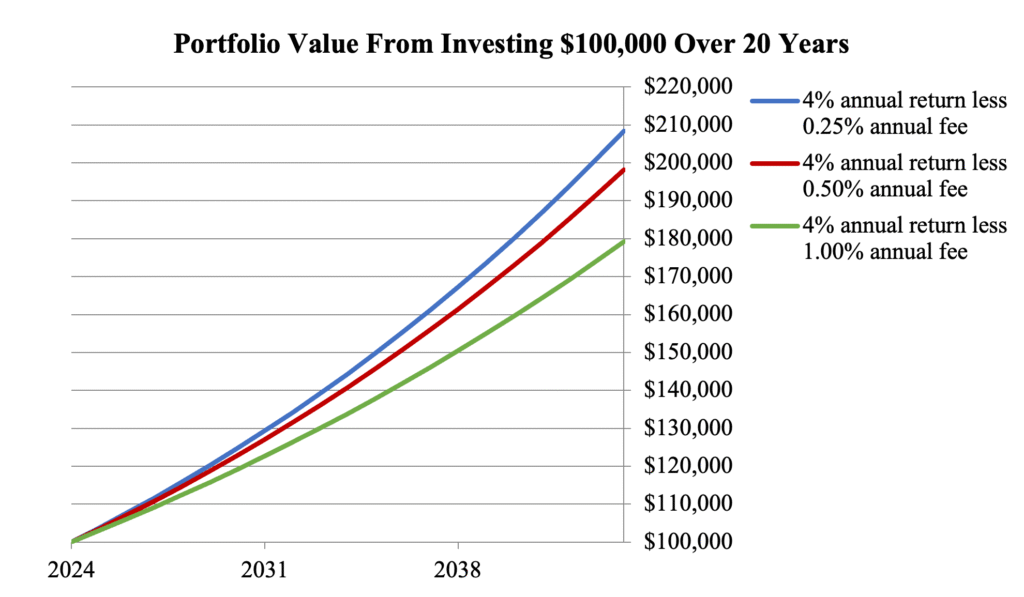

Rule 9: Keep Investment Costs Low

Image Source: Investor.gov

Your investment returns suffer from hidden costs, and Rule 9 of personal finance rules becomes vital to build wealth. Small differences in fees can snowball over time and might cost you hundreds of thousands of dollars.

Explanation of Investment Costs

Management fees (0.25% to 1%), expense ratios (0.1% to over 1%), and trading fees make up investment costs. These small expenses cut into your portfolio’s growth potential. A portfolio that earns 8% annually with 1% in fees gives you only a 7% net return. This gap creates a huge loss of wealth over decades. The math shows that a $100,000 investment over 30 years loses nearly $400,000 when paying 2% fees instead of 0.25%.

Why Top 1% Follow This Rule

Smart investors know that fees eat into their reinvestment potential. The average Vanguard mutual fund expense ratio stands at 0.07%, while the industry charges 0.44% on average. This 84% gap makes a huge difference in long-term growth. Most actively managed funds fail to beat the market despite their higher fees.

How to Apply This Rule

These steps help keep investment costs low:

- Pick low-cost index funds and ETFs with expense ratios under 0.1%

- Stay away from funds with front-end loads that take up to 5.75% of your investment

- Cut down on trading to reduce transaction fees

- Compare investment options using fee calculators

Mehnav helps clients choose budget-friendly investments that boost returns. Our advisors stress that lower costs let your money work harder for you.

Rule 10: Set Clear Financial Goals

Image Source: InCharge Debt Solutions

A clear roadmap to wealth separates financially successful people from those who struggle with money. Rule 10 of personal finance rules can transform your vague financial hopes into achievable realities.

Explanation of Financial Goal Setting

Financial goal setting creates specific, measurable objectives that guide your money decisions. Your goals typically fall into three categories: short-term (within a year), mid-term (3-5 years), and long-term (5+ years). You’ll likely overspend, under-save, and miss opportunities without clear objectives. The SMART framework—specific, measurable, achievable, realistic, and time-bound—helps create goals that work.

Why Top 1% Follow This Rule

87% of American millionaires know exactly when to save and spend, while only 66% of the general population shares this clarity. Wealthy people recognize that goals help prioritize spending and investing decisions. The numbers tell the story – 78% of wealthy individuals see themselves as disciplined planners with specific financial targets. This clarity builds confidence about their financial future.

How to Apply This Rule

Here’s how you can use this crucial personal finance rule:

- Assess your current financial situation first

- Define specific targets with numbers and deadlines

- Prioritize goals based on importance and feasibility

- Break larger goals into smaller milestones

- Automate contributions toward your goals

Mehnav helps clients transform financial dreams into concrete plans with measurable steps. Our Mehnav advisors stress that regular goal reviews keep you accountable and adaptable as your life changes.

Rule 11: Use a Written Investment Policy

Image Source: Investopedia

A written investment policy statement structures your money management strategy. Rule 11 of personal finance rules shows you how to create this powerful document that stops emotional investment decisions.

Explanation of Investment Policy Statement

An investment policy statement (IPS) is a document that outlines the guidelines to manage your investments. This strategic guide documents your investment objectives, risk tolerance, and asset allocation targets. The IPS also establishes ways to measure and monitor your investment portfolio over time. Consider it your personal investment constitution that guides you during market turbulence. Writing this document makes you think systematically about your investment approach.

Why Top 1% Follow This Rule

Wealthy people know an IPS keeps them focused on long-term objectives rather than reacting to market swings. This policy stops the “Monday morning quarterbacking” that happens when investments underperform. The financial elite’s experience shows that an IPS creates accountability and offers an objective path during volatile market periods. You’re more likely to make impulsive decisions based on daily events without a written policy.

How to Apply This Rule

Your own investment policy should:

- Document your investment goals and time horizon

- Specify your target asset allocation with acceptable ranges

- Define criteria to select investments

- Establish monitoring and rebalancing frequency

Mehnav’s team helps clients develop tailored investment policies that match their financial goals. Our advisors suggest reviewing your IPS yearly to ensure it lines up with your current situation. Mehnav’s approach emphasizes that a well-constructed IPS supports disciplined investing instead of emotional reactions to market changes.

Rule 12: Learn Continuously About Money

Image Source: National Financial Educators Council

Financial education fuels your wealth-building experience. Rule 12 of personal finance rules shows that learning about money should be a lifelong process.

Explanation of Financial Education

Learning about finances gives you the information, skills, confidence, and motivation you need to make smart money decisions. This knowledge includes budgeting, debt management, investment selection, and retirement planning. You can achieve financial health when you maintain daily stability, build resilience against setbacks, and secure your future.

Why Top 1% Follow This Rule

Wealthy people make continuous financial learning a key part of their strategy to maintain wealth. They learn about investment opportunities, emerging industries, and financial trends regularly. Self-made millionaires know the simple facts about their earnings, assets, and investment costs. These successful clients include financial education in their detailed financial plans among budgeting, insurance, and estate planning.

How to Apply This Rule

You can implement this personal finance rule through these steps:

- Check out free resources like MyMoney.gov from the Financial Literacy and Education Commission

- Read one finance book monthly and follow reliable financial news sources

- Track spending with budgeting apps to understand your habits better

- Find transparent financial advisors who work as both partners and educators

Need a website that’s fast, beautiful, and built to rank? Mehnav creates modern, secure websites that Google loves — lightning-fast, mobile-friendly, and SEO-optimized. We make explainer videos to boost your brand and help you rank on Google, ChatGPT, and AI search results. Let’s build your success online — Contact Mehnav — only a few slots remain this month!

Rule 13: Protect Yourself with Insurance

Image Source: eMoney Advisor

Insurance protects your wealth when life throws unexpected challenges your way. Rule 13 of personal finance rules helps you build a strong financial foundation against possible disasters.

Explanation of Insurance in Finance

You need insurance to avoid devastating financial losses from unexpected events. Life, health, auto, and long-term disability make up the four main types of insurance. Your family gets support from life insurance if you die unexpectedly – experts suggest a payout of 10 times your yearly income. Health insurance keeps you safe from huge medical bills. The average family plan costs $22,463 per year through employer programs. You can’t ignore disability insurance since one in four workers ends up disabled before reaching retirement age.

Why Top 1% Follow This Rule

The wealthy see insurance differently – it’s about preserving wealth, not just protection. We learned that a single accident without proper coverage could wipe out decades of careful saving. Many rich people use life insurance as a smart tool for estate planning, quick cash access, and tax benefits. High-net-worth individuals feel more confident with insurance because it tackles specific risks that could shake their financial stability.

How to Apply This Rule

Here’s how you can put this personal finance rule to work:

- Start with life, health, disability, and liability coverage

- Look over your policies every year as your wealth and family grow

- Add specialized policies like umbrella liability when your assets increase

- Find the sweet spot between deductibles and premiums for the best coverage cost

Mehnav helps clients pick the right insurance coverage that fits their wealth protection strategy.

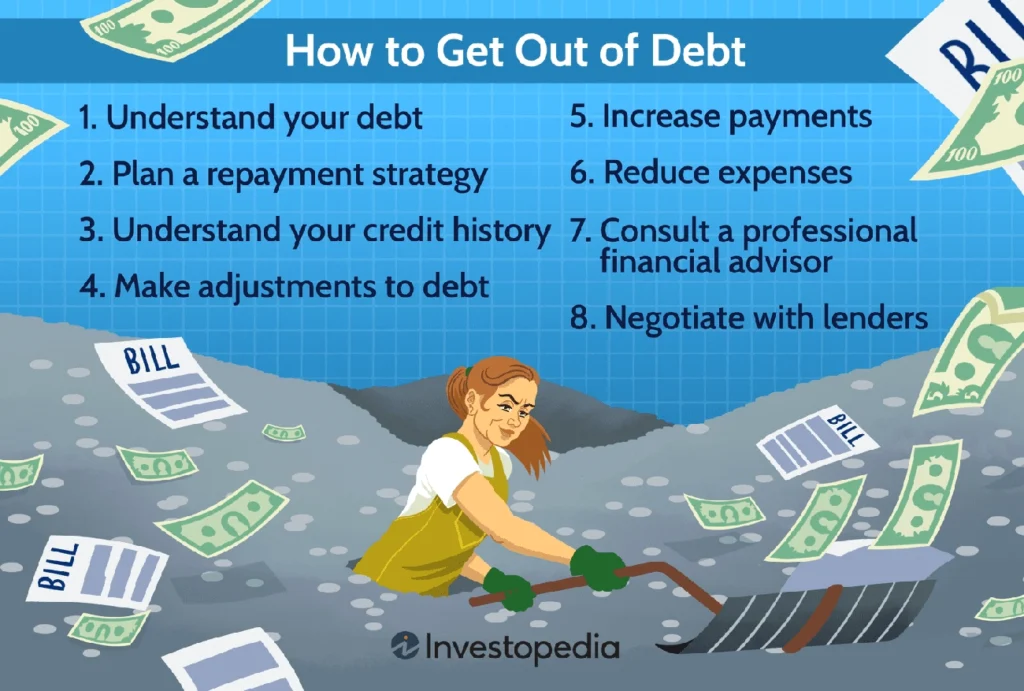

Rule 14: Avoid High-Interest Debt

Image Source: Investopedia

High-interest debt destroys wealth faster and blocks the path to financial success. Rule 14 of personal finance rules targets one of the biggest roadblocks to financial freedom.

Explanation of High-Interest Debt

High-interest debt has rates above 8%. Credit cards average nearly 24% interest today, which jumped from 12.9% a decade ago. A $5,000 credit card balance at 24% APR creates about $1,200 in interest just in the first year. This debt snowballs and makes even small balances grow dramatically over time.

Why Top 1% Follow This Rule

The wealthy know that high-interest debt eats away wealth faster than most investments can build it. They see interest payments as missed opportunities for wealth building—$10,000 spent on credit card interest over a decade could grow beyond $20,000 through investments instead. They also use debt wisely by choosing low-interest options that can yield returns above their borrowing costs.

How to Apply This Rule

Here’s how to put this personal finance rule into action:

- The avalanche method works best—pay minimums on all debts while putting extra money toward your highest-interest debt first

- Look into debt consolidation through lower-rate personal loans (averaging 12.33% versus 21.76% for credit cards)

- Minimum payments stretch out repayment and pile up interest costs—pay more when possible

- An emergency fund keeps you from turning to high-interest credit when unexpected costs hit

Mehnav helps clients create strategies to eliminate high-interest debt and build lasting wealth.

Rule 15: Marry Someone with Similar Financial Values

Image Source: FREEPIK

Your long-term wealth might depend most on picking a partner who shares your money values. Money disagreements rank among the leading causes of relationship conflict. These conflicts create more tension than most other common problems.

Explanation of Financial Compatibility

You and your partner need similar approaches to handle money – that’s what financial compatibility means. This goes beyond how much you both earn. The way you view saving, spending, debt, and financial goals matters more. Money choices reflect your values, morals, and who you are. We noticed couples struggle with stress when their financial attitudes don’t match up.

Why Top 1% Follow This Rule

Rich people know that matching money values helps build both relationships and wealth. Couples who feel they share financial values report greater relationship satisfaction overall. The research shows open discussions about money pave the way to shared success. Money fights can stop couples from building security and wealth. Wealthy people stay away from these pitfalls.

How to Apply This Rule

This personal finance rule works best when you:

- Talk about money goals and worries without pressure

- Build a shared money vision with both quick wins and future dreams

- Learn about each other’s money mindset based on childhood and life experiences

- Show understanding and support during money disagreements

Comparison Table

| Rule | Key Explanation | Why the 1% Follow It | Main Implementation Steps |

|---|---|---|---|

| Rule 1: Always Pay Off Your Credit Card | Stops interest charges from piling up on purchases (APR 16-25%) | Better credit scores and shows you’re good with money | • Pay more than minimum payment • Set up automatic payments • Track spending • Think about balance transfer options |

| Rule 2: Spend Within Your Means | Your expenses shouldn’t exceed your income | Helps allocate money toward building wealth | • Track spending monthly • Create a budget • Identify wants vs needs • Save for large purchases |

| Rule 3: Pay Yourself First | Save 10-20% of your income before spending | Builds lasting financial security and makes the most of compound interest | • Set clear goals • Automate transfers • Start small • Track progress |

| Rule 4: Invest Consistently | Put money in regularly whatever the market does (dollar-cost averaging) | Takes emotion out of decisions and keeps you invested when markets drop | • Start right away • Automate investments • Increase contributions yearly • Stay disciplined during downturns |

| Rule 5: Avoid Lifestyle Inflation | Don’t boost spending just because your income rises | Extra income goes to savings rather than bigger expenses | • Make gradual lifestyle changes • Automate savings • Create spending guardrails • Choose experiences over things |

| Rule 6: Build an Emergency Fund | Keep separate savings for surprises (3-6 months expenses) | Quick access to cash without touching investments | • Start with $500-$1,000 goal • Keep funds accessible • Set up automatic transfers • Use windfalls to accelerate |

| Rule 7: Understand Time-Money Tradeoff | Your time has real value ($240/hr average) | Lets you focus on what truly matters | • Calculate your true hourly value • Compare costs for outsourcing • Value time appropriately • Think about well-being impact |

| Rule 8: Don’t Invest in What You Don’t Understand | You should explain your investments simply | Builds confidence when markets get rough | • Start with simple investments • Read monthly about investing • Test understanding by explaining • Skip FOMO-driven investments |

| Rule 9: Keep Investment Costs Low | Cut fees that eat into returns (aim for <0.1% expense ratios) | Every fee dollar could be growing instead | • Choose low-cost index funds • Skip front-end loads • Limit unnecessary trading • Use fee calculators |

| Rule 10: Set Clear Financial Goals | Make specific, measurable targets (SMART framework) | Makes decision-making easier | • Look at current situation • Define specific targets • Break into smaller milestones • Automate contributions |

| Rule 11: Use Written Investment Policy | Write down your investment rules and strategy | Stops you from reacting emotionally to market changes | • Write down investment goals • Specify asset allocation • Define selection criteria • Set monitoring schedule |

| Rule 12: Learn Continuously About Money | Keep learning about money and building skills | Makes managing and growing wealth easier | • Use free resources • Read monthly finance books • Track spending habits • Ask for professional help |

| Rule 13: Protect Yourself with Insurance | Guard against big financial losses | Keeps your wealth safe from surprises | • Start with basic coverage • Review policies yearly • Look into specialized policies • Balance deductibles/premiums |

| Rule 14: Avoid High-Interest Debt | Get rid of debt above 8% interest | Stops interest payments from eating your wealth | • Use avalanche method • Look into debt consolidation • Pay more than minimum • Build emergency fund |

| Rule 15: Marry Someone with Similar Financial Values | Find someone who thinks about money like you do | Makes building wealth together easier | • Talk about money regularly • Create shared vision • Understand money mindsets • Practice responsive behaviors |

Conclusion

The wealthy have used these 15 personal finance rules as their path to financial freedom for decades. You can build wealth steadily by applying these principles – no matter your current financial situation. Success with money doesn’t come from luck or inheritance. It comes from staying disciplined and consistent with proven strategies.

Pick one rule to start with today. You could pay off credit cards, set up an emergency fund, or track your spending. These small steps add up to big results over time when you stick with them. The compound growth becomes more powerful the earlier you start these practices.

Financial success grows from good habits, not quick fixes. The wealthy stay rich because they follow these rules consistently – not just sometimes. It also helps to have a partner who shares your money values throughout your wealth-building experience.

Need a website that’s fast, beautiful, and built to rank? Mehnav creates modern, secure websites that Google loves — lightning-fast, mobile-friendly, and SEO-optimized. We make explainer videos that boost your brand and help you rank on Google, ChatGPT, and AI search results. Let’s build your success online — Contact Mehnav — only a few slots left this month!

The actions you take today shape your financial future. Master one rule this month before adding another. The path to financial freedom isn’t about being perfect – it’s about making progress. These time-tested principles work when you put them into action – starting now.

Key Takeaways

These 15 proven personal finance rules reveal the disciplined strategies that separate the wealthy from those struggling financially, offering actionable steps anyone can implement to build lasting wealth.

• Pay yourself first and invest consistently – Automate 10-20% of income to savings before expenses, then invest regularly regardless of market conditions to maximize compound growth.

• Eliminate high-interest debt immediately – Credit card debt at 24% APR destroys wealth faster than most investments can build it; prioritize paying off balances above 8% interest rates.

• Live below your means and avoid lifestyle inflation – Spending less than you earn creates the foundation for wealth building; resist upgrading expenses when income rises.

• Build emergency funds and protect with insurance – Maintain 3-6 months of expenses in accessible savings and secure proper coverage to prevent financial disasters from derailing progress.

• Keep investment costs low and understand what you buy – Choose index funds with expense ratios below 0.1% and only invest in what you can explain simply to others.

The gap between what you earn and spend determines your financial success. These rules work when applied consistently over time, transforming financial habits into lasting wealth through disciplined execution rather than perfect timing.

FAQs

Q1. What is the most important rule of personal finance?

The most fundamental rule is to spend less than you earn. This allows you to save and invest for the future, building wealth over time. Only by living below your means can you create financial stability and freedom.

Q2. How should I allocate my income for budgeting?

A popular guideline is the 50/30/20 rule – allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This provides a balanced approach to managing your finances while still saving for the future.

Q3. Why is it important to have an emergency fund?

An emergency fund acts as a financial safety net, protecting you from unexpected expenses or loss of income. Aim to save 3-6 months of living expenses in an easily accessible account to avoid going into debt when emergencies arise.

Q4. Should I focus on paying off debt or investing?

Generally, prioritize paying off high-interest debt (like credit cards) before investing heavily. However, take advantage of any employer 401(k) match first. Once high-interest debt is eliminated, you can focus more on investing for long-term growth.

Q5. How can I start investing with little money?

Begin with low-cost index funds or ETFs that provide broad market exposure. Many brokerages offer fractional shares, allowing you to invest small amounts regularly. Consistently investing even small sums can lead to significant growth over time due to compound interest.