Financial freedom means your passive income is more than your expenses, which lets you live your ideal life without a job. The average 65-year-old American has only $300,000 in retirement savings—nowhere near enough to live comfortably. The situation looks bleaker since almost 30% of retirees rely mainly on Social Security income.

Financial freedom puts you in control of your money instead of your money controlling you. The path to financial freedom isn’t complex, but it needs steadfast dedication. Your early retirement dreams become more realistic the sooner you start working toward this goal. A well-planned budget and continuous learning are the foundations of a financially free life. These skills give you the ability to make smarter money decisions.

This piece outlines four proven strategies that will help you break free from financial stress. You’ll find ways to build a strong foundation, get rid of debt, grow your wealth through investments, and create passive income streams that work for you. Your path to financial independence starts right here!

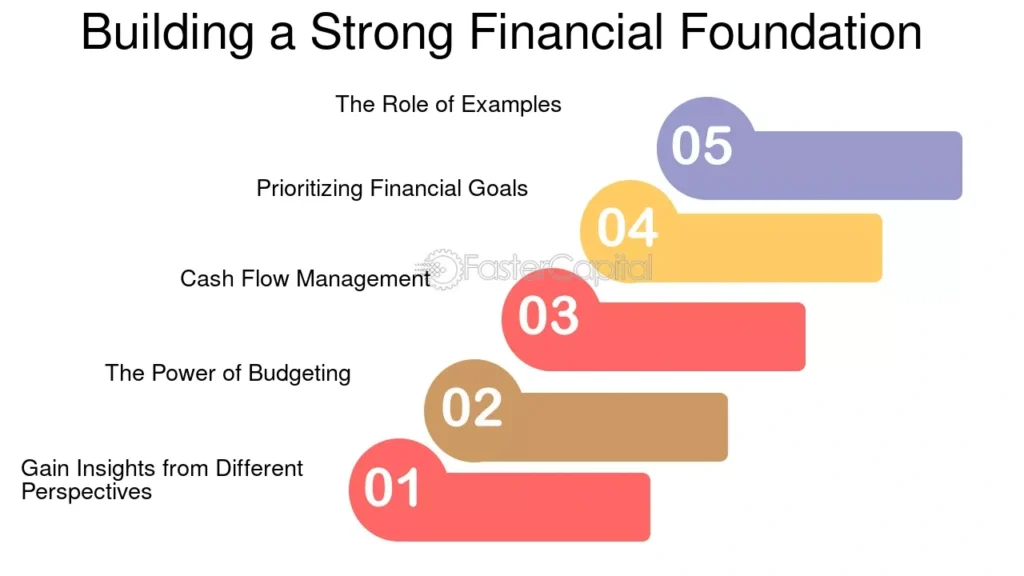

Step 1: Build a Strong Financial Foundation

Image Source: FasterCapital

“Financial responsibility is a mindset before it is an action. Therefore, if you can change a mindset, the actions follow almost naturally.” — Brandon Turner, Real estate investor, author, and host of the BiggerPockets Podcast

Your path to **financial freedom** starts with a strong foundation. You need to understand your money situation and set clear goals before exploring complex strategies.

Clarify your financial goals and values

Your values show who you are and shape your decisions and choices. Most Americans believe they must give up their core values to reach financial goals. You can avoid this by knowing what matters most to you.

List your top values. Family ranks high (important to 75% of survey respondents). Other common values include faith, health, financial security, service to others, and meaningful work. These values should guide how you spend and manage your money.

Understand what financial freedom means to you

Financial freedom means something different to everyone. Most people see it as having enough money to live without stress. Some want to cover monthly bills and still buy what they want. Others aim for minimal debt and substantial savings.

A strong financial base needs two things: you should own more than you owe (positive net worth) and bring in more than you spend (positive cash flow). Your personal definition helps you set the right goals.

Create a simple budget that works

Budgeting lets you control your money instead of restricting you. This process gives you the ability to spend on what matters most. A budget that works starts with your net income—the money you take home after taxes and deductions.

Split your expenses into:

- Fixed expenses (necessities like housing, healthcare, transportation)

- Financial security contributions (savings, investments)

- Discretionary expenses (entertainment, dining out)

The 50/30/20 rule might help: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

Track your income and expenses

Expense tracking plays a vital role in following your budget. You might overspend and lose your way to financial independence without knowing where your money goes.

Write down every transaction during the month. Subtract each payment from its budget category when you pay bills, buy groceries, or make purchases. This helps you see what’s left in each category and stops overspending.

Pick a tracking method that suits you—a spreadsheet, budgeting app, or pen and paper. Set up a regular schedule to check your spending daily, weekly, or monthly.

Step 2: Eliminate Debt and Create Safety Nets

Building your financial foundation comes first, and dealing with debt becomes your next priority on the path to financial freedom. Getting rid of what you owe and creating safety nets are significant steps toward financial independence.

Use the debt snowball or avalanche method

Two strategies work well to become debt-free:

- Debt snowball method: Pay off your smallest debts first, whatever the interest rates. This creates quick wins that build motivation as you see immediate progress.

- Debt avalanche method: Target debts with the highest interest rates first. This approach saves more money over time by eliminating your most expensive debts right away.

The avalanche method could save you hundreds in interest. The snowball method provides psychological momentum that helps you stay committed.

Build a starter emergency fund

Your emergency fund acts as a financial safety net for unexpected costs like medical bills, car repairs, or job loss. Studies show people without savings struggle to bounce back from financial shocks and often turn to credit cards, which creates more debt.

Start by saving enough to cover at least half a month’s expenses for immediate spending shocks. You should build toward three to six months’ worth for income protection.

Avoid lifestyle inflation

Lifestyle inflation happens when your spending increases with your income. This dangerous pattern makes achieving financial freedom harder because you earn more but save the same or less.

To curb this, set clear spending and saving targets whenever your income increases. Put your money into experiences rather than material possessions. Make gradual lifestyle changes instead of dramatic ones.

Understand the cost of bad debt

Bad debt substantially hurts your path to financial freedom. It creates a cycle of living paycheck to paycheck with just enough money to cover bills. It also stops you from building emergency funds and saving for retirement.

Boost your savings rate whenever your income grows. Focus on eliminating high-interest consumer debt first to minimize the financial damage.

Step 3: Grow Income and Start Investing

“It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.” — Robert Kiyosaki, Author of ‘Rich Dad Poor Dad’, entrepreneur, and financial educator

Building a strong foundation and getting rid of debt sets the stage for your next significant steps – growing your income and investing to reach financial freedom. These strategies will change your money situation from barely getting by to thriving.

Increase your active income through skills or side hustles

A side hustle can speed up your path to early retirement. Your monthly savings will jump by 50% if you direct a modest side income of $100 per month to investments while saving $200 from your main job. You could earn $25+ per hour from tutoring, join focus groups paying $50-$200 per session, or make $19 hourly plus tips from delivery services.

Start investing with small, consistent amounts

Success in investing comes from starting early and staying consistent rather than having big money upfront. Small initial investments that grow with your income work well. Your investments should be automated to maintain discipline and avoid spending money that could work for you.

Broaden across stocks, real estate, and retirement accounts

Your investments should cover different asset classes to lower risk and boost returns:

- Stocks and bonds (different sectors and regions)

- Real estate (directly or through REITs)

- Cash alternatives for short-term needs

Use tax-advantaged accounts like IRAs and 401(k)s

Money grows faster in tax-advantaged accounts:

- 401(k) plans: Pre-tax contributions that may include employer matching

- Traditional IRAs: Tax-deferred growth until retirement

- Roth IRAs: Tax-free withdrawals in retirement if you meet requirements

Understand your risk tolerance

Your risk tolerance depends on how willing and able you are to handle investment ups and downs. These factors matter:

- Your investment timeline (longer horizons allow for more risk)

- Your financial cushion (emergency savings)

- Your comfort level with market changes

Are you ready to take your first step toward financial freedom? Mehnav creates websites and digital tools that help people and businesses grow faster, attract more clients, and build steady income streams. Our websites turn visitors into customers, just like a financial freedom plan works step by step. Start your experience with Mehnav today.

Step 4: Create Passive Income and Plan Your Legacy

Image Source: First Financial Consulting

The last step to financial freedom involves creating eco-friendly passive income streams that work while you sleep. This vital phase revolutionizes your active efforts into lasting wealth.

Build passive income streams like rental properties or dividends

A portfolio that generates steady income to cover life’s expenses helps you live off dividends. A couple needing $66,000 yearly would need about $1.4-1.8 million in dividend-yielding assets. Rental properties offer consistent income, but the math needs careful consideration. You’d need to charge $3,133 monthly rent to get $10,000 yearly cash flow with a $2,000 monthly mortgage and $300 in expenses.

Automate your savings and investments

Money management becomes easier with automation. Recurring investments help your financial plan stay on track whatever market fluctuations occur. Automated investing reduces spending temptations and eliminates market timing urges.

Define your long-term legacy goals

Smart legacy planning reduces tax liabilities that could lower inheritance value. Clear intentions with beneficiaries help prevent family conflicts during tough times.

Protect your wealth with insurance and estate planning

Life insurance, especially when you have irrevocable trusts, lets you control how and when death benefits get distributed. This strategy creates liquidity for beneficiaries and minimizes taxes.

Mehnav helps you take the first step toward financial freedom. We build websites and digital tools that help businesses and individuals grow faster, attract clients, and build lasting income streams. Our websites convert visitors into customers systematically, just like a well-planned financial strategy. Start your experience with Mehnav today.

Conclusion

Financial freedom isn’t some far-off dream. You can achieve it with the right approach. This piece outlines four practical steps that will reshape your financial future. A strong foundation comes first through clear goals and smart budgeting. Next comes tackling your debts and creating safety nets to protect what you’ve built. Then you can focus on growing your income and making investments that work for you over time.

The final piece involves setting up passive income streams that generate money with minimal effort. These steps build on each other and create a path to financial independence. The trip needs discipline and patience, but the freedom at the end makes it all worth it.

Note that small, consistent actions add up over time. You don’t need to change everything at once. Start with one area, become skilled at it, then move forward. No matter where you are in your financial progress, Mehnav is ready to support your goals.

Mehnav’s team knows financial freedom ties directly to your online success. Our websites and digital tools help grow your business, bring in more clients, and create lasting income streams. We build your online presence one customer at a time as you build your financial future.

Start today. Your future self will thank you for the financial freedom you’ve created. Mehnav helps turn your financial and business goals into reality at every step.

Key Takeaways

Financial freedom is achievable through a systematic four-step approach that transforms your relationship with money and creates lasting wealth-building habits.

• Build your foundation first: Create a clear budget, define your financial goals, and track every expense to gain control over your money flow.

• Eliminate debt strategically: Use either the debt snowball or avalanche method while building an emergency fund to protect against financial setbacks.

• Grow income through investing: Start with small, consistent investments in tax-advantaged accounts like 401(k)s and IRAs while diversifying across asset classes.

• Create passive income streams: Build rental properties, dividend portfolios, and automated investment systems that generate money while you sleep.

• Automate your wealth building: Set up recurring investments and savings to remove emotional decision-making and ensure consistent progress toward financial independence.

The key to success lies in starting early and staying consistent—even small actions compound dramatically over time. Financial freedom isn’t about earning more money; it’s about making your money work harder for you through strategic planning and disciplined execution.

FAQs

Q1. How much money do I need to achieve financial independence and retire early? The general rule of thumb is to save 25 times your annual expenses. Calculate your yearly expenses by multiplying your monthly expenses by 12, then multiply that figure by 25 to determine your FIRE (Financial Independence, Retire Early) number. This amount should theoretically sustain your lifestyle in retirement.

Q2. Is it possible to retire at 62 with $400,000 in a 401(k)? While it’s possible to retire at 62 with $400,000 in a 401(k), it may be challenging to maintain your desired lifestyle. Working and saving for a few more years could significantly improve your financial comfort in retirement. Consider factors like your expected expenses, other income sources, and potential healthcare costs.

Q3. What strategies can I use to eliminate debt faster? Two effective strategies for debt elimination are the debt snowball and debt avalanche methods. The snowball method involves paying off the smallest debts first for quick wins, while the avalanche method targets high-interest debts to save more money over time. Choose the method that aligns best with your financial situation and motivation style.

Q4. How can I create passive income streams for financial freedom? You can create passive income through various means such as dividend-yielding investments, rental properties, or automated investment systems. For example, to generate $66,000 annually from dividends, you might need $1.4-1.8 million invested in dividend-yielding assets. With rental properties, calculate your desired cash flow and adjust rent accordingly to cover expenses and mortgage payments.

Q5. What’s the importance of automating savings and investments? Automating your savings and investments is crucial for consistent progress towards financial freedom. It removes the emotional aspect of money management, reduces the temptation to spend, and eliminates the urge to time the market. By setting up recurring investments, you ensure your financial plan stays on track regardless of market fluctuations or personal spending impulses.