Net worth growth presents challenges but remains achievable. Investment experts suggest you can turn €67,000 into €200,000-€400,000 in just 4-5 years. Success depends on careful planning and steady action.

Most people’s approach to building net worth fails to meet ambitious targets. Reaching €400,000 through five years of investing would need either unrealistic 30% annual returns or monthly contributions of €3,500-€4,000.

Money’s doubling time becomes clear through the Rule of 72. Your investment doubles in 6 years with a 12% annual return, while an 8-year period needs a 9% return. The average investor achieves money doubling in seven years with 10% yearly returns.

Building wealth relies heavily on compounding. A €10,000 investment at 6% annual return grows to €10,600 after one year. Returns generate additional returns as time passes, which leads to exponential growth.

The classic strategy to double your money lies in portfolio diversification. Traditional 60/40 portfolios (60% equities, 40% bonds) have yielded about 8.6% annually. This approach suits most investors’ needs.

This piece outlines practical steps that will help you double your net worth in 5 years through basic mathematics and time-tested strategies.

1. Understand the Math Behind Doubling Net Worth

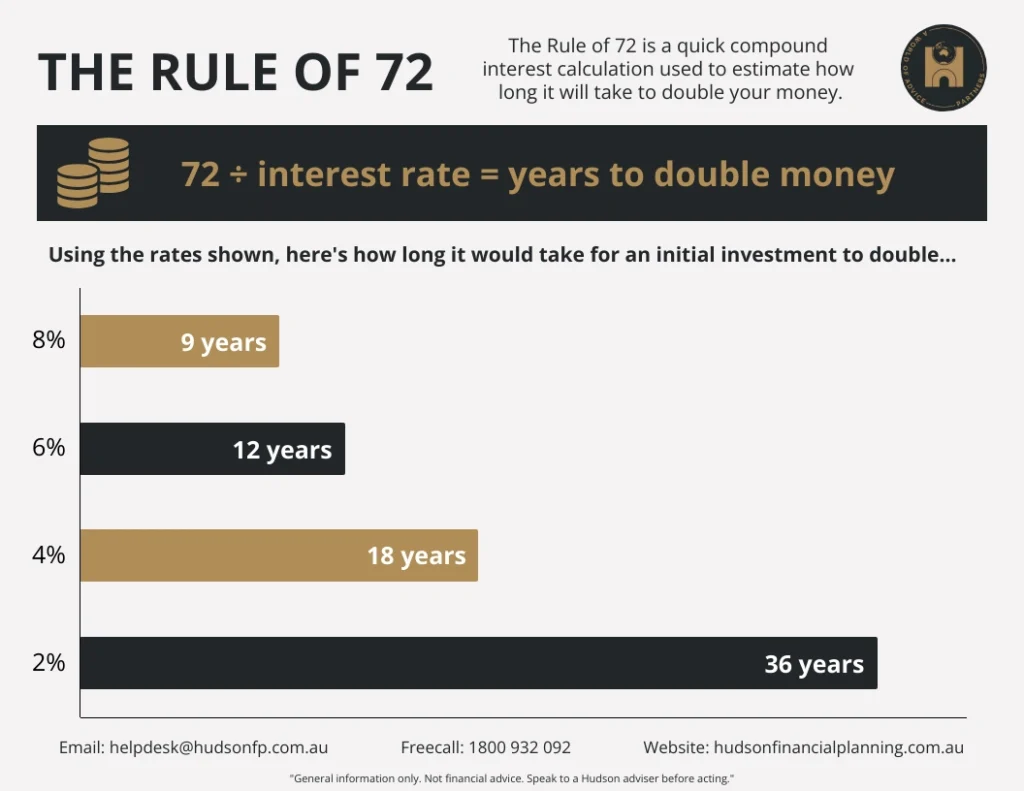

Image Source: Hudson Financial Planning

Building wealth twice as fast requires you to understand basic math principles. These principles explain why some people grow their money faster than others even when they make the same income.

What is the Rule of 72?

The Rule of 72 offers the quickest way to figure out when your money will double at a given interest rate. You just divide 72 by your expected yearly return percentage.

Here’s how it works:

- At 6% yearly return: 72 ÷ 6 = 12 years to double

- At 9% yearly return: 72 ÷ 9 = 8 years to double

- At 12% yearly return: 72 ÷ 6 = 6 years to double

This rule works both ways. You can find out what return rate you need to double your money in a specific time. Let’s say you want to double your money in 5 years – you’d need about 14.4% yearly returns (72 ÷ 5).

The Rule of 72 gives the best results with return rates between 6% and 10%. For other rates, you might want to use financial calculators or spreadsheets.

How compounding works over time

Compounding creates wealth when your returns earn their own returns. The growth looks small at first, but it becomes huge over long periods.

Look at what happens to $10,000 over 48 years with different rates:

- At 3%: Grows to $40,000

- At 6%: Grows to $160,000

- At 12%: Grows to $2,560,000

The 8-4-3 rule shows how wealth growth speeds up. You build your base in the first 8 years. The next 4 years often double your original gains. The last 3 years bring explosive growth that matches everything before.

Why time horizon matters more than return rate

Time ends up mattering more than return rate when building wealth. Investors who stayed invested through bad times made twice as much as those who kept money in cash-like investments over 20 years.

Starting early gives you more chances to double your money. A five-year delay means your $10,000 investment at 7% yearly would reach only $53,865 instead of $76,123 after 30 years – this is a big deal as it means that you lose over $22,000.

Market timing rarely works. Your best bet is to keep investing steadily in all market conditions. Success comes from staying in the market, not from trying to time it perfectly.

2. Build a Realistic Savings and Investment Plan

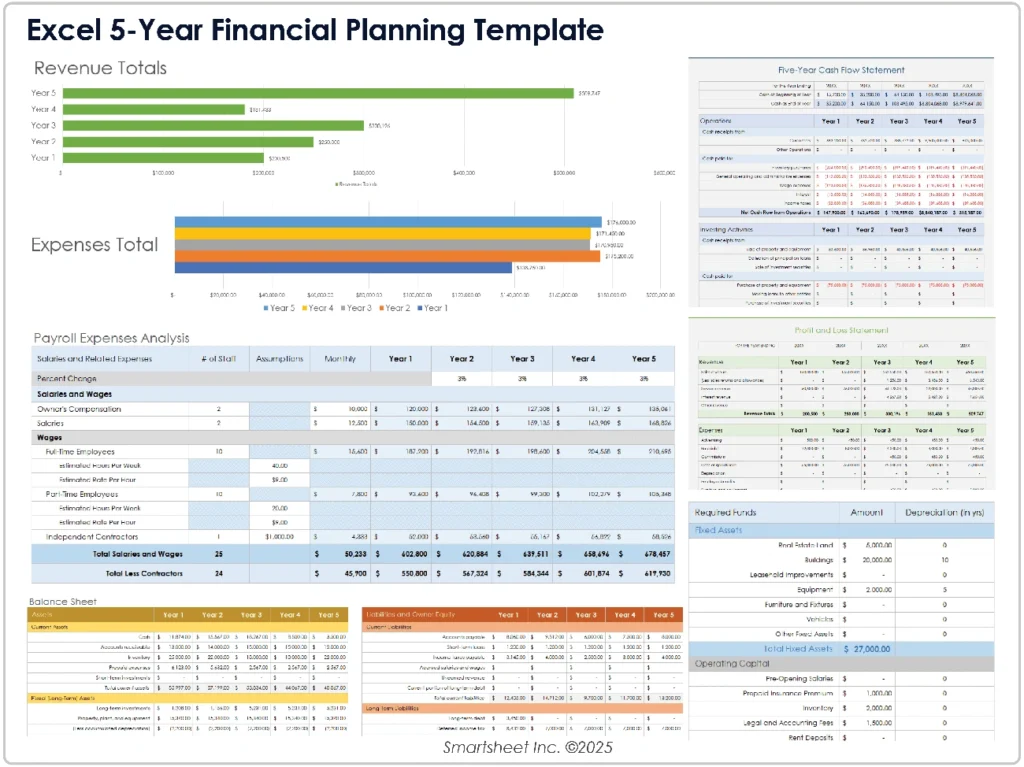

Image Source: Smartsheet

A realistic plan plays a significant role in doubling your net worth. The math principles you understand should translate into concrete actions that fit your financial situation.

Set a 5-year net worth goal

Your specific financial target should follow the SMART formula – make your goal Specific, Measurable, Achievable, Relevant, and Time-bound. The first step is to calculate your current net worth by subtracting your total debts from your assets. This baseline will help you set a clear doubling target with a five-year deadline.

Calculate how much you need to save monthly

Your goal will determine your required monthly savings. To double your money in five years, you’ll need approximately 14.4% annual returns (using the Rule of 72). Take a good look at your current financial situation—income, expenses, and debts—to figure out how much you can realistically save each month.

Estimate expected return rates

Realistic expectations come from understanding potential returns. The S&P 500’s annual returns averaged about 9.8% (including dividends) from 1928 through 2023. Investment-grade corporate bonds yielded 6.7% during this same period. A classic 60/40 portfolio (60% equities, 40% bonds) would have generated approximately 8.6% annually.

Use a compound interest calculator

Planning becomes easier with online calculators that show your investment’s growth over time. The Compound Interest Calculator from Investor.gov helps you visualize compound interest’s impact. The Savings Goal Calculator shows your required monthly contributions to reach your savings target. You can enter your original investment, monthly contributions, predicted rate of return, and time horizon to check if your plan matches your five-year doubling goal.

3. Choose the Right Mix of Investment Options

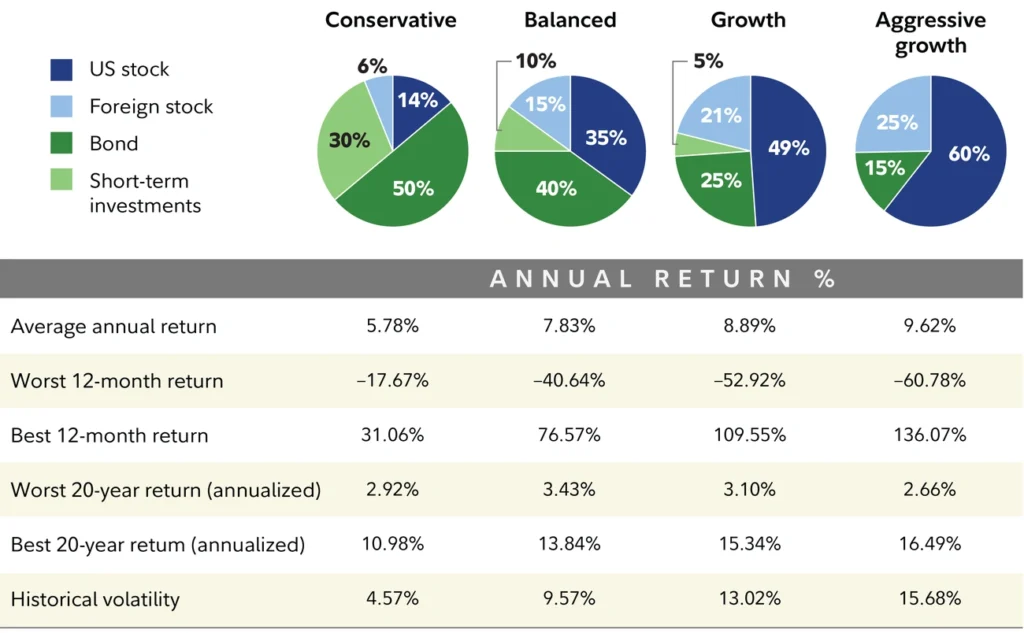

Image Source: Fidelity Investments

The right investment mix creates the foundations to grow your net worth properly. Your choices directly affect potential returns and risk exposure.

Equities vs. Bonds: Risk and reward

Stocks have historically beaten bonds with the S&P 500 returning about 9.8% annually compared to 6.7% for investment-grade corporate bonds. However, stock prices swing more dramatically. Bonds bring stability during economic uncertainty and provide steady income through regular interest payments.

Mutual funds and ETFs for beginners

ETFs and mutual funds give you built-in diversification through baskets of stocks or bonds. Both options provide:

- Professional management that watches your investments

- Market access without buying individual securities

- Lower startup costs than buying individual stocks

Real estate and REITs

REITs help you invest in income-producing real estate without direct property purchases. They usually pay higher dividends than common stocks because they must distribute 90% of taxable income to shareholders.

Tax-advantaged accounts like 401(k) and IRAs

Your employer’s 401(k) match should be your first priority—it’s risk-free money. The 401(k) contribution limits will reach $23,500 ($31,000 if over 50) by 2025. Traditional IRAs give immediate tax benefits, while Roth IRAs let you withdraw tax-free in retirement.

Avoiding high-fee products

Small fee differences affect your net worth growth by a lot. Low-cost index funds with fees under 0.20% help your returns grow. Reducing fees by 1% could add $300,000 more at retirement.

4. Stay Consistent and Manage Risk

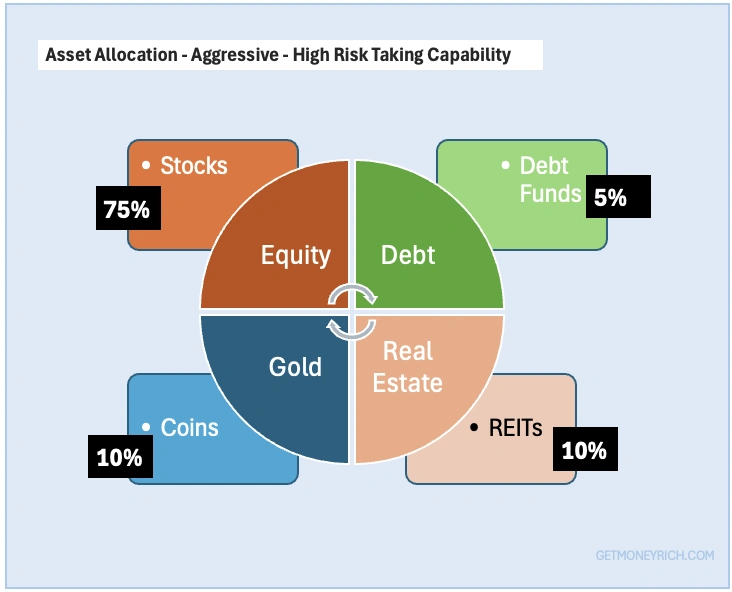

Image Source: getmoneyrich

Building consistency is the life-blood of doubling your net worth. Your most promising investment plan can falter without proper risk management.

Rebalance your portfolio regularly

Your investments need rebalancing to maintain target allocation when they drift. Most investors find annual rebalancing effective, though some prefer quarterly reviews. This process helps manage risk by selling investments that have grown too large and buying those that have become smaller. The goal is risk management rather than maximizing returns.

Avoid emotional investing

Poor investment decisions often stem from emotions. Studies show that investors who act on fear or excitement instead of strategy typically earn 2.2% less annually. You should create a market volatility response plan before market swings happen and outline specific actions at different market thresholds.

Emergency fund and liquidity planning

Your emergency fund acts as a financial buffer. People with savings of at least $2,000 report 21% higher financial well-being. They also spend less time managing finances—just 3.7 hours weekly compared to 7.3 hours for those without savings. Smart liquidity planning means you won’t need to sell investments at bad times.

Track your progress every 6 months

Monitoring your net worth twice a year helps you spot problems early. Set calendar reminders with specific questions that go beyond checking account balances.

Growing your net worth needs the right strategy—just like growing your business online. 💡 At Mehnav, we build websites and SEO plans that boost your digital value and bring real returns. Let’s grow smarter together 👉 mehnav.com

Conclusion

You can double your net worth in five years with mathematical understanding and consistent action. The Rule of 72 shows that this goal just needs approximately 14.4% annual returns on your investments. Compounding works best when you give it enough time and keep adding to your portfolio regularly.

A realistic plan becomes your foundation for success. You should calculate your current net worth, set specific targets, and determine monthly savings requirements based on expected returns. The right investment mix between equities, bonds, funds, and possibly real estate will substantially affect your growth trajectory.

Consistency separates successful investors from those who fall short of their goals. Regular portfolio rebalancing, emotional discipline, and adequate emergency funds protect your investments during market volatility. Of course, tracking your progress every six months helps you stay accountable and make adjustments along the way.

Growing your net worth takes the right strategy—same as growing your business online. 💡 At Mehnav, we build websites and SEO plans designed to boost your digital value and bring real returns. Let’s grow smarter together 👉 mehnav.com

Financial success rarely happens by accident. It comes from thinking over your plans, smart investing, and patient execution over time. Start applying these principles today to position yourself to double your net worth within the next five years.

Key Takeaways

Master these essential strategies to systematically double your net worth through proven mathematical principles and disciplined investing.

• Use the Rule of 72: You need approximately 14.4% annual returns to double your money in 5 years (72 ÷ 5 = 14.4%)

• Leverage compound interest: Time matters more than return rate – starting early creates exponential wealth growth through multiple doubling periods

• Build a diversified portfolio: Mix 60% equities and 40% bonds for historical 8.6% annual returns while managing risk effectively

• Stay consistent and disciplined: Rebalance annually, avoid emotional investing, and maintain emergency funds to protect long-term growth

• Track progress regularly: Monitor your net worth every 6 months and adjust your strategy to stay on target for your doubling goal

The key to doubling your net worth isn’t finding secret investment tricks—it’s understanding the math, creating a realistic plan, and executing it consistently over time. Start with your current net worth calculation, set your 5-year target, and begin investing systematically today.

FAQs

Q1. How long does it typically take to double your net worth? Using the Rule of 72, it generally takes about 7-10 years to double your net worth, assuming a 7-10% average annual return on investments. However, this can vary based on factors like investment choices, market conditions, and additional contributions.

Q2. What’s the most effective way to increase net worth quickly? The fastest way to increase net worth is through a combination of consistent saving, smart investing in diversified portfolios, and increasing your income. Focus on maximizing tax-advantaged accounts, minimizing high-fee products, and maintaining a long-term perspective on wealth building.

Q3. Is it possible to double your money in 5 years? While challenging, doubling your money in 5 years is possible with the right strategy. It would require approximately 14.4% annual returns, which is higher than average market returns. This might involve a more aggressive investment approach or significant additional contributions to your investment portfolio.

Q4. How important is asset allocation in growing net worth? Asset allocation is crucial for growing net worth. A diversified portfolio balancing stocks, bonds, and potentially real estate can help manage risk while pursuing growth. The classic 60/40 portfolio (60% stocks, 40% bonds) has historically provided balanced returns, but your ideal allocation depends on your risk tolerance and financial goals.

Q5. What role does compound interest play in doubling net worth? Compound interest is a powerful force in wealth accumulation. It allows your money to grow exponentially over time as you earn returns not just on your initial investment, but also on the accumulated returns. This effect becomes more pronounced the longer your money remains invested, making time a critical factor in doubling your net worth.