How to retire early without a massive salary? It’s possible. Many people follow the FIRE method — saving over half their income — to escape the 9–5 grind early and live on their own terms.

The FIRE movement has gained popularity, but not many U.S. workers actually leave their jobs early. Most people think they’d have to be wealthy to retire early. But financial independence doesn’t just need a massive income. Many people who want to retire early plan to live on half their income or even less.

Saving more for retirement sounds simple enough. The tricky part is figuring out how to do it. FIRE might require you to save 30% or more of what you make. The good news? Smart financial planning can help even modest earners create their path to freedom.

This piece will show you practical ways to find your FIRE number (usually 25 times what you spend yearly). You’ll learn how to boost your savings without a six-figure salary and build a timeline that makes sense for your early retirement goals.

How to Retire Early with the FIRE Movement

Image Source: AAA

The FIRE movement makes shared freedom from traditional retirement timelines possible. “Your Money or Your Life” by Joe Dominguez and Vicki Robin sparked Financial Independence, Retire Early’s popularity in the 1990s. This lifestyle approach defies conventional financial wisdom and encourages aggressive saving paired with smart investing.

What is financial independence retire early?

FIRE’s core concept revolves around building wealth that sustains you without a regular job. The basic principle goes beyond the standard 10-15% savings rate financial planners recommend. FIRE enthusiasts save between 50-75% of their income.

Your FIRE number calculation needs 25 times your yearly expenses. This math aligns with the 4% rule that suggests yearly withdrawals of 4% from retirement savings will sustain your funds.

The movement presents different paths based on your goals:

- LeanFIRE: Living frugally with minimal expenses, requiring a smaller investment portfolio

- FatFIRE: Maintaining or upgrading your lifestyle, typically requiring a larger savings target

- BaristaFIRE: Working part-time after partially retiring to cover some expenses

- CoastFIRE: Building an investment portfolio that grows through compound interest alone

Why FIRE isn’t just for high earners

In stark comparison to this common belief, your path to financial independence doesn’t depend on income level. The average annual salary in the United States is $66,662, which supports a successful FIRE journey. The gap between earnings and spending matters more substantially.

Simple math proves this point: someone earning $1 million who spends $500,000 reaches financial freedom at the same pace as someone earning $50,000 who spends $25,000. Your savings rate determines your path to financial independence more than your income level.

People without six-figure salaries should focus on their savings percentage. Moving to areas with lower living costs helps make FIRE more achievable with modest incomes.

Common myths about early retirement

Myth 1: You need a high-paying job to build wealth for early retirement A National Study of Millionaires reveals that all but one of these millionaires never earned six figures in any working year. Money habits shape wealth building more than income level.

Myth 2: Early retirement means never working again FIRE followers often plan to continue working. They seek financial independence to pursue meaningful work without money pressure. A Federal Reserve study shows that 68% of people would keep working even without needing the income.

Myth 3: The earlier you retire, the better Retirement timing substantially affects your savings. A typical couple aged 45 and 50 with $2.2 million invested has 90% success odds retiring at 67, but only 67% at age 60. An 18-month break reduces success odds by just 3%.

Myth 4: FIRE means escaping all life’s stresses Financial independence won’t fix everything. Early retirement without purpose can lead to boredom. The Federal Reserve found that 30% of retirees returned to work.

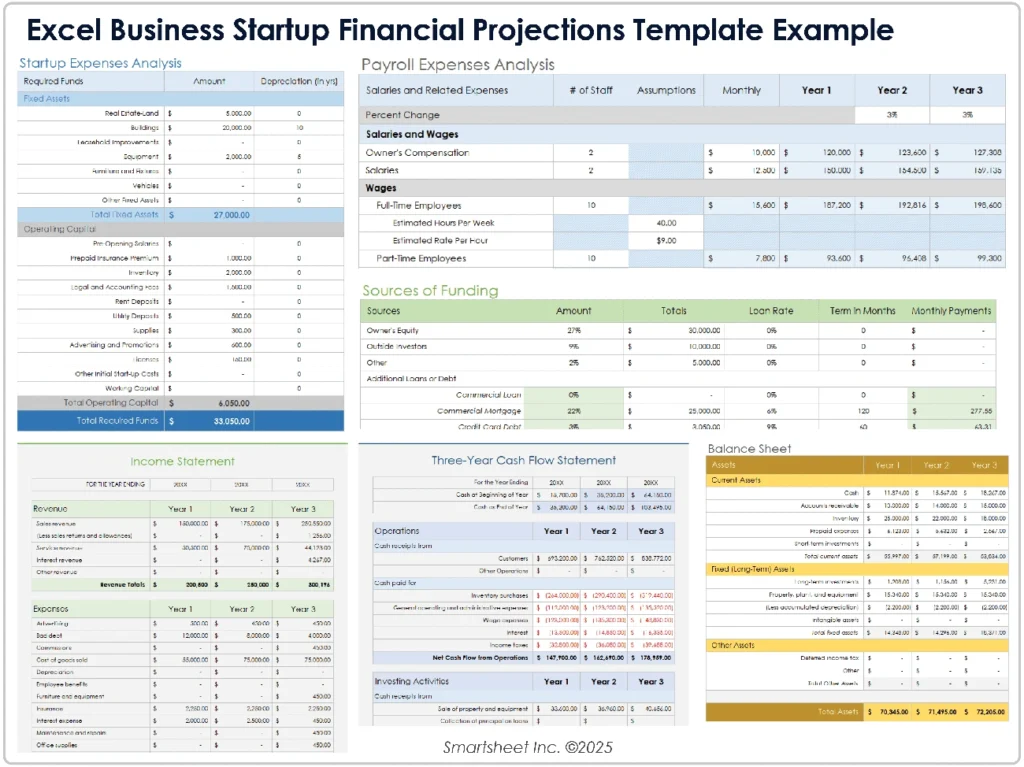

Assess Your Current Financial Situation

Image Source: Smartsheet

Your path to early retirement starts with a clear snapshot of your finances. A solid grasp of your financial situation will shape all your future FIRE decisions. Building wealth on a modest salary begins when you really understand your digital world.

Track your income and expenses

Your financial habits become crystal clear when you track every dollar coming in and going out. Anyone serious about retiring early needs this financial X-ray.

The first step is to record all your income and expenses for at least three months. These tools can make the process easier:

- Spreadsheets for customizable tracking

- Budgeting apps like Mint or YNAB

- Simple notebook to record expenses mindfully

Break down your expenses into meaningful categories to see where your money flows. You can analyze your spending patterns and spot the difference between needs (housing, food, utilities) and wants (dining out, entertainment). This helps you cut non-essential spending ruthlessly.

Watch out for “budget leaks” – those recurring expenses that drain your money without giving much value back. Unused subscriptions, frequent dining out, and impulse purchases often top this list. Plugging these leaks frees up more money for your retirement experience without needing a six-figure salary.

Build an emergency fund

Your financial safety net on the road to independence comes from an emergency fund. Without this protection, surprise expenses might force you into debt or make you tap into retirement accounts during market downturns, which derails early retirement plans.

Regular financial advice suggests keeping 3-6 months of living expenses, but early retirement seekers should aim higher. Experts say retirees should keep 12-24 months of expenses in available accounts. This bigger cushion matters because:

- Regular paychecks won’t be there anymore

- Healthcare costs go up as you age

- You won’t need to sell investments when markets drop

Put your emergency fund where you can reach it easily but still earn something, like high-yield savings accounts or money market funds. On top of that, it makes sense to top up your emergency fund after using it.

Eliminate high-interest debt

High-interest debt blocks your path to early retirement. Statistics Canada shows many people start their financial life with big debts — college graduates average $16,700 in student loans, while bachelor’s degree holders carry around $30,600.

The good news? Debt won’t stop you from reaching FIRE. All the same, tackling high-interest debt should be your priority before heavy investing. Credit card debt with 18-20% interest rates gives you a guaranteed return that the stock market can’t match consistently.

We focused on eliminating:

- Credit card balances

- Payday loans

- High-interest personal loans

Debt consolidation or refinancing might help lower your interest rates and speed up repayment. Low-interest debts like mortgages can wait, especially if they offer tax benefits.

A solid foundation for early retirement planning emerges once you track finances, build your emergency fund, and kill high-interest debt. These three steps create financial breathing room that lets you save and invest aggressively — the real engines of financial independence.

Set Realistic Savings and Retirement Goals

Image Source: FreePik

Your early retirement success depends on setting a clear target for your nest egg. Blind saving won’t work – you need specific numbers to reach your goals. Let’s figure out exactly what you need.

How much do I need to retire early?

The “FIRE number” determines how much money you need to sustain your lifestyle without working. This number equals 25 times your annual expenses. To name just one example, a yearly expense of $40,000 means you need $1 million.

Your retirement timeline plays a big role in these calculations. Retiring at 67 means saving 10x your pre-retirement income. This number jumps to 12x for age 65, but drops to 8x if you wait until 70. Even a small delay in retirement can reduce your required savings.

These age-based milestones help track your progress:

- 1x your income by age 30

- 3x by age 40

- 6x by age 50

- 8x by age 60

Understanding the Rule of 25 and 4% rule

The Rule of 25 and the 4% rule work together. One helps calculate your savings goal, while the other guides your withdrawal strategy.

The 4% rule, now 30 years old, shows you can safely withdraw 4% of your portfolio in your first retirement year and adjust for inflation yearly. A $1.5 million nest egg lets you withdraw $60,000 in year one.

Historical market returns show this method has a 96% success rate over 30 years of retirement. Risk-averse investors might prefer a 3% withdrawal rate – “as close to a guarantee as we have in this life” – which means multiplying annual expenses by 33.

Adjusting your FIRE number for taxes and inflation

Taxes and inflation can derail your FIRE plans if you don’t account for them properly.

Inflation hits purchasing power hard. A $5 item today might cost $10 in twenty years. The average inflation rate since 1913 sits at 3.1% annually. Planning to retire in 20+ years? You might need double your calculated FIRE number to maintain your lifestyle.

Many early retirees pay less tax than expected. Smart planning lets you enjoy six-figure annual spending with minimal or zero income tax through qualified dividends and strategic withdrawals.

Your plan can take two routes:

- Use a conservative 6-7% return rate that includes inflation

- Plan for a 9% market return and increase withdrawals by 3% yearly for inflation

The first option gives you a safer estimate for early retirement planning.

Maximize Savings Without a 6-Figure Salary

Image Source: Entrepreneur

Early retirement needs you to make the most of every dollar. You must create a big gap between what you earn and spend, even without a big salary.

Cut unnecessary expenses

Your investment funds grow right away when you reduce spending. Track all your expenses for three months to spot where money gets wasted. Here are some effective ways to cut costs:

- Cook at home instead of eating out – you could save thousands each year

- Look at your subscriptions every month and cut what you don’t use

- Wait 30 days before buying non-essential items to avoid impulse purchases

- Call to get better rates on insurance and internet bills

Automate your savings

After cutting expenses, automation will give a steady saving pattern. Your payday should trigger automatic transfers from checking to savings accounts. This keeps the money out of sight and removes the urge to spend what you should save.

Want to grow your income online — even without a 6-figure salary? At Mehnav, we build modern websites, boost Google rankings with SEO, and create powerful explainer videos that convert.

Use tax-advantaged accounts wisely

These accounts offer the best tax benefits:

- Get your employer’s full 401(k) match – it’s free money you shouldn’t pass up

- Use Roth IRAs for tax-free growth and withdrawals (2024 contribution limit: $7,000 plus an additional $1,000 for those over 50)

- HSAs offer triple tax advantages worth looking into

Side hustles and part-time income options

A modest extra income can speed up your path to FIRE. Side jobs bringing in $300-$500 monthly will boost your savings rate through investments. Here are some options:

- Freelance using skills you already have

- Drive for rideshare or deliver food

- Start a small online store

- Rent out extra space in your home or property

Plan for Healthcare, Taxes, and Income Gaps

Image Source: The Retirement Manifesto

Healthcare costs play a vital role when you plan to retire early. Your financial independence dreams could fall apart without proper preparation.

Health insurance options before Medicare

The healthcare marketplace provides good coverage options until Medicare kicks in at 65. Tax credits helped 92% of marketplace enrollees get coverage in 2024. Your spouse’s employer plan could be another option for coverage, but monthly premiums might cost more.

You can keep your employer coverage through COBRA for up to 18 months, but you’ll likely pay the full premium. Medicaid might work for you if your retirement income is low and you meet your state’s requirements.

Our team at Mehnav will help you understand your healthcare options to plan a successful early retirement.

Tax-efficient withdrawal strategies

Smart retirement planning means taking money from different accounts instead of emptying them one by one. This approach can cut your lifetime taxes by over 40% and keep your tax bills steady throughout retirement.

Taxable accounts should be your first choice if you qualify for the 0% capital gains rate. A strategic approach to filling lower tax brackets helps you avoid Required Minimum Distributions pushing you into higher brackets later.

Using a bridge account to access funds before 59½

Bridge accounts help you cover expenses between early retirement and age 59½ when you can access retirement funds without penalties. Bridge accounts, usually brokerage accounts, let you withdraw money anytime without penalties.

Mehnav’s retirement specialists will design a bridge account strategy that balances growth potential with the cash you need for your early retirement plans.

Conclusion

You don’t need a huge paycheck to achieve financial independence and retire early. Your savings rate plays a bigger role than your income level. Most FIRE followers save between 50-75% of their income by planning strategically and spending wisely.

Your FIRE number equals 25 times your annual expenses. This simple calculation gives you a clear target instead of random saving. Your retirement funds will last through your golden years when you factor in inflation and taxes.

Early retirement becomes more achievable when you put your savings on autopilot, clear high-interest debt, and make the most of tax-advantaged accounts. A side hustle that brings in just $300-500 monthly can speed up your path to financial freedom.

Healthcare planning plays a crucial role for anyone who wants to retire early. You should look into marketplace plans, your spouse’s coverage, or bridge strategies until you qualify for Medicare at 65. Smart withdrawal methods can stretch your nest egg by a lot.

Financial freedom doesn’t have to wait until your 60s. Average earners can achieve FIRE with discipline and proper planning. Here at Mehnav, we help direct clients toward these strategies to build a comfortable early retirement without the six-figure salary most people think they need. Take your first step today – financial independence might be closer than you imagine.

Key Takeaways

Early retirement is achievable without a massive salary through strategic planning and disciplined saving habits that anyone can implement.

• Your savings rate matters more than income level – Save 50-75% of income by cutting expenses and automating transfers to reach FIRE faster than high earners who overspend.

• Calculate your FIRE number using the Rule of 25 – Multiply annual expenses by 25 to determine retirement savings needed, then withdraw 4% annually.

• Eliminate high-interest debt before aggressive investing – Pay off credit cards and loans first since guaranteed 18-20% returns beat uncertain market gains.

• Use tax-advantaged accounts strategically – Maximize 401(k) employer matches, contribute to Roth IRAs, and leverage HSAs for triple tax benefits.

• Plan for healthcare costs before Medicare eligibility – Research marketplace plans, COBRA options, or spouse coverage to bridge the gap until age 65.

The key insight: someone earning $50,000 who spends $25,000 reaches financial independence at the same rate as someone earning $1 million who spends $500,000. Focus on creating the largest possible gap between what you earn and what you spend, regardless of your starting salary.

FAQs

Q1. Is it really possible to retire early without a six-figure salary?

Yes, it’s possible to retire early without a high income. The key is to focus on your savings rate rather than your salary. By living frugally, maximizing savings, and investing wisely, even those with modest incomes can achieve financial independence and retire early.

Q2. How much do I need to save to retire early?

The general rule of thumb is to save 25 times your annual expenses. This is known as your “FIRE number.” For example, if you need $40,000 per year to live comfortably, you’d aim to save $1 million. However, this number should be adjusted for inflation and potential tax implications.

Q3. What are some effective ways to increase savings on a modest income?

To boost savings on a modest income, focus on cutting unnecessary expenses, automating your savings, maximizing tax-advantaged accounts like 401(k)s and IRAs, and considering side hustles for additional income. Even small amounts saved consistently can make a significant difference over time.

Q4. How can I handle healthcare costs if I retire before Medicare eligibility?

Before becoming eligible for Medicare at 65, early retirees can explore options such as health insurance marketplace plans, joining a spouse’s employer plan, or using COBRA coverage. It’s crucial to factor in these potential costs when planning for early retirement.

Q5. What’s the best strategy for withdrawing money in early retirement?

A tax-efficient withdrawal strategy often involves taking proportional withdrawals from different account types rather than emptying accounts sequentially. This approach can help reduce lifetime taxes and create more stable tax bills throughout retirement. Consider consulting with a financial advisor to develop a personalized strategy.