Financial challenges for millennials are at an all-time high. U.S. consumers saw their credit card debt jump by 16.3% in just one year. Food costs rose by 5.7% while rents shot up by 8.5%. These numbers explain why 36% of millennials consider cost of living their biggest worry.

Breaking free from this cycle is possible. Several millennials have retired decades ahead of schedule. Peter Adeney, known as Mr. Money Mustache, saved around $600,000 and retired at age 30. The FIRE movement (Financial Independence, Retire Early) shows that you can stop working 20+ years earlier than planned.

Your path to financial freedom starts with basic steps. Start by building an emergency fund of $1,000. Next, become skilled at budgeting that helps you save and invest while living comfortably. A $40k salary gives you roughly $2,666 monthly after taxes – enough money to make progress with the right plan.

Would you like to find how to escape the 9-5 grind before you turn 40? Let’s look at the millennial money strategies that can reshape your financial path.

1. Understand the Millennial Money Mindset

Image Source: FReepik

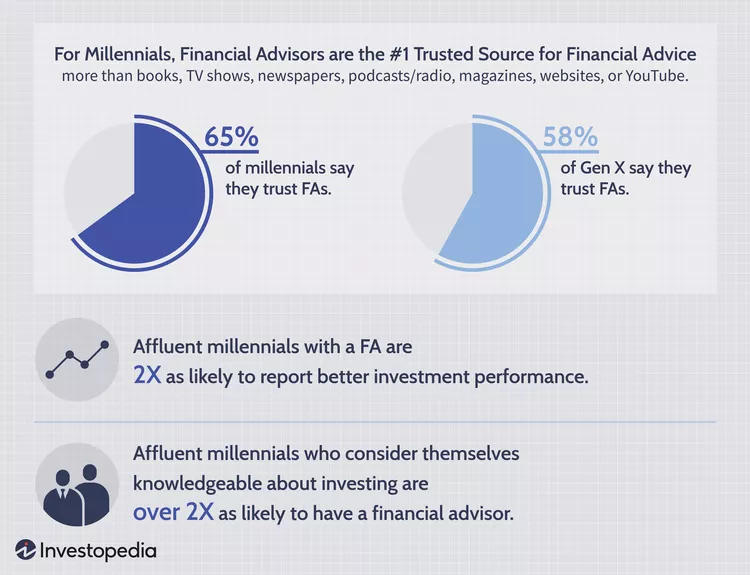

Millennials look at money differently than their predecessors. Born between 1981 and 1996, these young adults create their own roadmaps to wealth and freedom instead of following traditional financial paths.

Why millennials are redefining retirement

The old notion of stopping work at 65 is outdated. Millennials see retirement as a flexible concept that focuses on financial independence rather than age. Research shows 37% of Americans want a different retirement lifestyle than previous generations. They seek more active (42%), adventurous (39%) retirements that leave room for passion projects (37%).

Economic necessity drives this change as much as personal choice. Many millennials started their careers during economic downturns, faced student loan debt, dealt with stagnant wages, and rising living costs. So about 35% view retirement as a major challenge, while 32% don’t believe they’ll ever “fully” retire.

These obstacles haven’t stopped millennials from saving. Their average 401(k) savings rate reaches 12.7% (including employer contributions), with typical balances of $62,000. Roth IRA contributions have jumped by 17.7% in early 2024.

The rise of the millennial-revolution FIRE movement

Financial Independence, Retire Early (FIRE) might be the most radical millennial money philosophy. This movement pushes for extreme savings – up to 75% of yearly income – to retire decades before the usual age.

FIRE works on a simple idea: once savings hit about 25 times your yearly expenses (your “FIRE number”), you can leave your day job and withdraw small amounts (3-4% annually) for living costs. The movement gained popularity recently, but its roots go back to the 1992 book Your Money or Your Life by Vicki Robin and Joe Dominguez.

Different FIRE versions fit various lifestyle priorities:

- Lean FIRE: Lives minimally to save faster

- Fat FIRE: Targets a more comfortable lifestyle with bigger savings

- Barista FIRE: Leaves traditional 9-5 jobs but keeps part-time work for extra income

- Coast FIRE: Meets financial goals but works to cover expenses while investments grow

How early millennials are shifting financial priorities

Millennials reshape their entire relationship with money beyond just rejecting traditional retirement. They value flexibility, purpose, and experiences more than owning things.

Financial independence matters more to this generation than fixed career paths. About 58% would work after retirement, with 41% doing it mainly for personal fulfillment. Deloitte’s 2025 Gen Z and Millennial Survey points out these generations want a “trifecta” of money, meaning, and well-being from their careers.

Side hustles and gig work have become popular ways to create multiple income streams. Millennials also invest differently, putting nearly three times more money into alternative investments like private equity, real estate, and cryptocurrency than older generations.

Technology shapes millennial money management significantly. This digital-first generation uses mobile banking, budgeting apps, and automated investment platforms that match their need for convenience and simplicity.

The millennial approach to money shows both practical adaptation to economic realities and a new vision of financial success. They create fresh paths to freedom through smart budgeting, strategic investing, and focusing on what matters most – paths their parents never imagined.

2. Set Clear Financial Goals Before 40

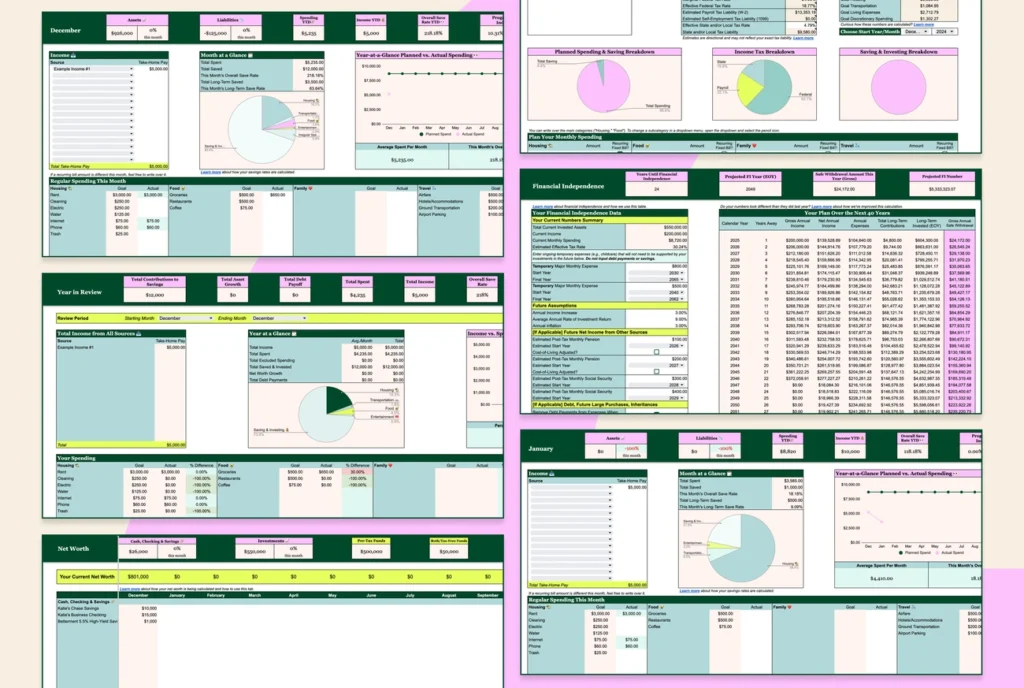

Image Source: Money with Katie

Clear financial targets create your roadmap to quitting the 9-5 job before 40. Your millennial money experience needs purpose and direction to make financial freedom possible decades earlier than previous generations thought possible.

Short-term vs long-term money goals

The difference between short-term and long-term goals helps you decide where your money goes. Short-term goals take less than a year to achieve and build your financial foundation. These might include:

- Creating a monthly budget

- Building an emergency fund (starting with $1,000)

- Paying off high-interest credit card debt

- Setting up automatic savings contributions

Long-term goals take five or more years and focus on securing your financial independence. Millennial wealth management typically includes these goals:

- Planning for early retirement

- Paying off a mortgage

- Creating generational wealth

- Establishing passive income streams

Balance between these timeframes matters greatly. Your emergency fund should be your top priority since unexpected expenses can derail long-term plans. Starting retirement contributions early makes sense even while paying off short-term debt.

How to line up goals with your values

Financial goals mean more when they reflect what truly matters to you. Money works as a tool to support your core values, not as an end goal itself.

You can learn what drives your millennial money management decisions by asking “What is important about money to me?”. Dig deeper by repeatedly asking “why” to each answer. This exercise shows your authentic motivations beyond surface-level financial targets.

Your spending should match your stated priorities. Many millennials feel disconnected between values and financial actions – like valuing environmental sustainability while investing in companies with poor environmental records.

Money decisions that support your values build confidence and purpose. This natural framework helps you make complex financial choices with greater clarity.

Using the millennial money book or planner

Millennial money books are a great way to get wisdom beyond simple tactics. Quality books teach you to view money as a tool for improving your life, unlike articles covering specific questions like tax reduction.

Millennials’ financial planning books like “I Will Teach You to Be Rich” teach both fundamentals and strategies for automation. “Financial Freedom” shows math-backed approaches to early retirement through investment strategies.

Specialized planners help track progress toward financial independence goals. These tools usually include:

- Space to document short and long-term goals

- Budget tracking sheets

- Debt payoff calculators

- Investment allocation guidance

- Net worth statements

A dedicated planner keeps you focused on priorities while showing your progress visually. This accountability increases your chances of achieving financial freedom before 40.

3. Master Budgeting and Eliminate Debt

Image Source: DeckLinks

Millennials need to become skilled at budgeting before building wealth and leaving the 9-5 grind early. A solid financial plan starts with dissecting your income and expenses.

Budgeting for millennials: tools and tips

Your net income—take-home pay after taxes and deductions—forms the starting point. You should track all expenses for several weeks to see where your money goes. This simple practice reveals spending patterns you might miss.

These proven budgeting methods work well:

- 50/30/20 budget: Allocate 50% to needs, 30% to wants, and 20% to savings or extra debt payments

- Zero-based budget: Give every dollar a purpose so income minus expenses equals zero

- Pay-yourself-first budget: Save money immediately, then handle bills and spend what’s left

Modern apps make budgeting simple by connecting accounts, sorting expenses, and handling payments automatically.

Cutting lifestyle inflation and unnecessary expenses

Many millennials stay trapped in the paycheck-to-paycheck cycle because they increase spending with each raise. Smart millennials put that extra money into savings and investments instead of upgrading their lifestyle.

Subscription services can drain your income quietly over time. The average millennial spends over $100 monthly on ride-shares. On top of that, food delivery costs five times more than home cooking.

You might want to think about cutting back on multiple vehicles, family cell phone plans (14% of Gen Xers still pay for their adult children), and clothing. Libraries offer free books and off-peak travel saves money.

Paying off high-interest debt first

High-interest debt (8% and above) hurts your financial health. Credit cards and personal loans usually charge the highest rates—15-30% and 10-29% respectively.

This debt grows faster, making it harder to manage as time passes. Your credit card balance might stay the same or increase even with minimum payments. Tackling high-interest debt should come before other money goals.

Using the avalanche or snowball method

Two strategies help you eliminate debt quickly:

The avalanche method tackles your highest-interest debts first. This approach saves more money in interest payments, especially when you have varying interest rates. You create a growing “avalanche” by applying freed-up money to the next highest-rate debt.

The snowball method pays off smallest balances first, whatever the interest rate. This might cost more in interest, but research shows it works better because quick wins build momentum. Each debt you clear gives you a mental boost to keep going.

Pick the method that lines up with your style and situation. Both paths can lead you to debt freedom and early retirement.

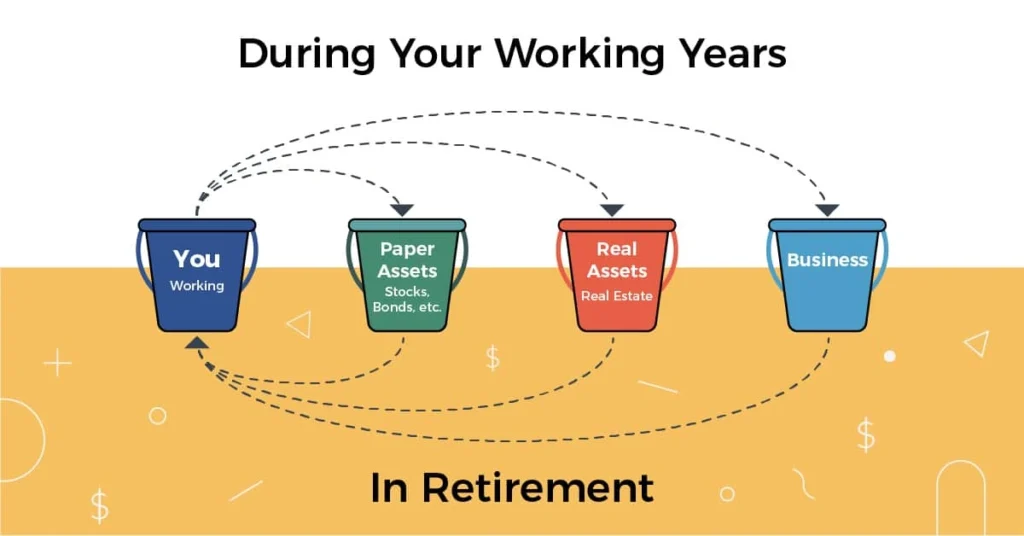

4. Build Wealth Through Smart Investing

Building millennial money through smart investing sets the foundation for early retirement. A solid financial future starts with establishing your budget and handling debt. The next step involves making your money work through well-planned investments.

Start with employer match and Roth IRA

Your company’s 401(k) match gives you free money you shouldn’t pass up. Most millennials actively participate in employer-sponsored retirement plans. Contributing enough to get your full employer match helps maximize your growth potential.

Roth IRAs give younger investors exceptional benefits. The tax structure works in your favor – you pay taxes now but withdraw tax-free during retirement. This approach makes sense because millennials’ tax brackets typically increase as their careers progress. The contribution limit for Roth IRA stands at $7,000 for 2025.

Open a brokerage account for flexibility

A brokerage account expands your investment options beyond retirement accounts. You get the freedom to manage your investments without withdrawal restrictions that come with retirement accounts. These accounts let you buy stocks, bonds, funds and other securities.

Note that trading investments in brokerage accounts can trigger capital gains taxes, unlike retirement accounts.

Millennial wealth management strategies

Your path to financial independence largely depends on how much you save. Financial experts suggest saving more than the standard 15% of income if early retirement is your goal.

Tax-advantaged accounts should be your priority since they reduce your tax burden now or during retirement. Health Savings Accounts (HSAs) bring triple tax benefits – deductible contributions, tax-free growth, and medical expense withdrawals without tax.

Diversify with ETFs and index funds

ETFs and index funds simplify investing while keeping costs low. The data shows that millennials and Gen Z lead in ETF adoption, with 81% and 75% respectively holding these investments in their retirement accounts.

These funds automatically invest in hundreds or thousands of companies, which gives you instant diversification without much effort. Many investors choose popular options like VTI (total US stock market), VXUS (international stocks), and BND (bonds).

5. Create Multiple Income Streams

Image Source: The College Investor

Broadening your income helps millennial money enthusiasts reach financial freedom faster. In fact, 66% of millennials have started or plan to start a side hustle this year.

Side hustles millennials actually enjoy

Millennials look for side hustles that give them flexibility and control. Almost half of all freelancers value knowing how to pick up extra work. Popular choices include:

- Delivering food or groceries through apps like DoorDash and Instacart

- Driving for rideshare companies such as Uber or Lyft

- Renting out unused space via platforms like Neighbor

Turning hobbies into income

Your favorite activities can become money-making ventures. Writing, photography, cooking, gardening, and crafting all have income potential. To name just one example, skilled photographers can earn money through wedding photography or selling stock photos. At Mehnav, we help you grow online with beautiful websites, powerful SEO, and explainer videos that sell your ideas — even while you sleep.

How to scale freelance or gig work

The freelance economy has 73.3 million Americans and will reach 76.4 million by 2024. Last year, 52% of Gen Z and 44% of millennials participated in freelance work. You can scale your gig work by:

- Building a strong personal brand that stands out

- Using content marketing strategies

- Cooperating with other professionals

Passive income ideas for millennials

Passive income makes money while you sleep. Some proven options include:

- Dividend stocks (yields ranging 3.2-4.92%)

- Creating and selling digital products like e-books or online courses

- Investing in crowdfunded real estate

- Renting out assets you already own

Multiple income streams create stability and boost your savings potential. This millennial approach helps you leave the 9-5 job sooner while doing work you truly love.

Conclusion

Millennial money management paves a clear path to break free from traditional retirement timelines. You can achieve financial independence before 40 by following these strategic steps. The path begins with FIRE movement principles and setting ambitious yet realistic goals.

Building an emergency fund and tackling high-interest debt creates a solid foundation for building wealth. The right budgeting method works best to control expenses and boost your savings rate. You can choose between 50/30/20, zero-based, or pay-yourself-first approaches. Simple changes like cutting subscription services and food delivery can save you hundreds each month.

Smart investing speeds up your path to early retirement. You should maximize employer matches, contribute to tax-advantaged accounts, and vary investments with ETFs and index funds. Your savings rate determines how quickly you’ll reach financial independence.

Multiple income streams provide security and growth potential. Side hustles that match your interests make the process enjoyable and speed up your progress. At Mehnav, we know that passive income from dividends, digital products, and real estate can boost your primary earnings by a lot.

The millennial revolution in personal finance shows that leaving the 9-5 before 40 isn’t just possible—people are doing it right now. These strategies, combined with consistent progress tracking, will help you join the growing community of financially independent millennials. Mehnav’s guidance for beautiful websites and powerful SEO helps grow your online presence and brings you closer to freedom from the traditional work timeline.

Key Takeaways

These proven strategies can help millennials escape the 9-5 grind and achieve financial independence before turning 40:

• Master the FIRE formula: Save 25x your annual expenses to withdraw 3-4% yearly and retire decades early

• Prioritize high-interest debt elimination: Use avalanche or snowball methods to tackle credit cards and loans before investing • Maximize tax-advantaged accounts first: Get full employer 401(k) match and contribute to Roth IRAs for tax-free retirement growth

• Create multiple income streams: Develop side hustles and passive income sources to accelerate your path to financial freedom • Align spending with values: Use budgeting methods like 50/30/20 to cut lifestyle inflation and redirect money toward investments

The millennial money revolution proves that traditional retirement timelines are outdated. By combining aggressive saving rates, smart investing in ETFs and index funds, and diversified income sources, you can build the wealth needed for early retirement while still enjoying life today.

FAQs

Q1. How much money do I need to quit my 9-5 job before 40?

The amount needed varies based on your lifestyle and expenses, but a general rule of thumb is to have 25-30 times your annual expenses saved and invested. For example, if you spend $40,000 per year, you’d need around $1-1.2 million invested to potentially retire early.

Q2. What are some strategies to build wealth quickly for early retirement?

Key strategies include maximizing tax-advantaged accounts like 401(k)s and IRAs, investing in low-cost index funds, developing multiple income streams through side hustles or passive income, and living well below your means to increase your savings rate.

Q3. Is day trading a viable way to make money for early retirement?

While some people do succeed at day trading, it’s extremely risky and most traders lose money long-term. It requires extensive knowledge, experience, and capital. For most people, consistent long-term investing in diversified index funds is a safer path to building wealth.

Q4. How can I create passive income streams to support early retirement?

Some popular passive income ideas include dividend stocks, rental real estate, creating and selling digital products, affiliate marketing, and peer-to-peer lending. However, most passive income streams require significant upfront work or capital to establish.

Q5. What mindset shifts are needed to achieve financial independence at a young age?

Key mindset shifts include prioritizing savings over spending, viewing money as a tool for freedom rather than consumption, being willing to live differently than peers, having a clear “why” for early retirement, and focusing on increasing your earning potential through continuous learning and skill development.