A surprising statistic shows that more than one-third of employees don’t feel confident about their retirement plans. Personal Capital addresses this widespread concern by helping you understand your finances without any cost.

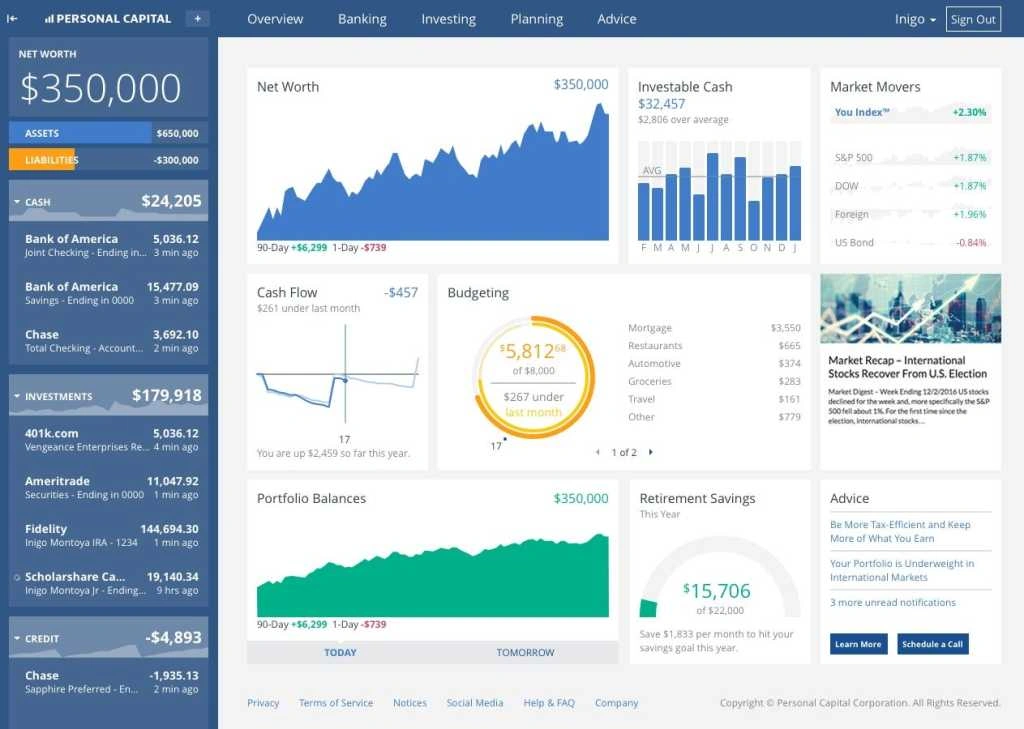

Personal Capital’s free financial dashboard consolidates all your accounts into a single view. This comprehensive platform tracks your investments, creates retirement plans, and handles budget management. The company, now owned by Empower, manages over $1 trillion in assets while serving more than 17 million customers.

The setup process takes minutes rather than hours. The user-friendly dashboard provides quick investment snapshots and individual-specific advice. These powerful tools demonstrate how your current financial decisions shape your retirement future. Let’s explore the hidden aspects of this robust financial platform that aren’t commonly discussed.

1. What is Personal Capital and Why It Matters

Overview of the platform and its purpose

Personal Capital launched in 2009 as a financial technology company that delivers advanced personal finance analysis tools and independent financial advice. This platform goes beyond simple budgeting apps. It’s a detailed financial management system that helps you track investments, calculate net worth, and plan for retirement.

The platform works as your financial command center. You can connect all your accounts – banks, brokerages, 401(k)s, mortgages, and credit cards. This gives you a complete view of your finances in one place. Having everything visible helps you make smarter money decisions.

Personal Capital’s services come in both free and paid versions. The free version gives you:

- A net worth tracker with live updates

- Cash flow and budgeting tools

- A retirement planner to check if you’re on track

- Investment portfolio analysis

- Fee analyzer to spot hidden costs

- Savings planner for financial goals

Personal Capital’s wealth management services target people with larger assets. You’ll need at least $100,000 to use their investment advisory services. Their advisors build custom strategies based on your financial goals and situation.

How it compares to traditional budgeting tools

Most budgeting apps focus on tracking spending and saving, with limited investment features. Personal Capital takes a different path. The platform includes simple budgeting tools, but it excels at investment tracking and retirement planning.

This platform shows how today’s financial choices shape your future. Its retirement planner runs complex simulations to check if your retirement savings will last. No other personal finance tool offers such detailed retirement planning with this flexibility and forecasting.

Personal Capital stands out by not showing ads. Many free financial tools depend on advertising revenue, but Personal Capital makes money through its premium wealth management services instead.

The platform’s investment tracking features set it apart. Users can see their asset allocation across seven categories and measure their portfolio’s performance against major stock market indices. Traditional financial advisors often charge thousands of dollars for similar features.

The shift from Personal Capital to Empower

Empower Retirement bought Personal Capital for $825 million plus a contingency payout in July 2020. Empower renamed Personal Capital and all its products by February 2023.

This merger created “Empower Personal Wealth,” combining Personal Capital with Empower Retirement Solutions Group. Empower now manages over $1.3 trillion in defined contribution assets.

These changes benefit users. Empower says the free dashboard remains “as robust, secure and easy to use as ever”. Users now have access to more detailed retirement services and custom solutions.

The financial dashboard that displays your assets and debts is now called “Empower Personal Dashboard“. Users can still access it online and through mobile apps.

Empower’s research revealed something interesting. People who connect their accounts to the financial dashboard save nearly twice as much for retirement compared to those who don’t. This discovery strengthened the company’s mission to help people understand their complete financial picture.

Edmund Murphy III, Empower’s president and CEO, noted that “customized, detailed, and easy-to-use digital experiences are creating remarkable changes in how Americans plan and manage their money”.

2. The Tools That Make Personal Capital Stand Out

Image Source: PC World

2. The Tools That Make Personal Capital Stand Out

Personal Capital gives you six powerful free tools that show your complete financial picture. These tools help you track everything from daily spending to long-term retirement goals in one easy-to-use dashboard.

Net worth tracker

Personal Capital’s flagship feature is the net worth tracker. It creates a dashboard that shows all your linked accounts in one clean chart. You can see your current net worth and track how it changes over time.

You can connect all your financial accounts without moving them anywhere else. The tracker gives you up-to-the-minute updates, so you always know where you stand financially each time you log in.

On top of that, you can add real estate properties and other assets to get an integrated view of your wealth. This detailed approach makes Personal Capital’s net worth tracker better than simple budgeting apps that just track spending.

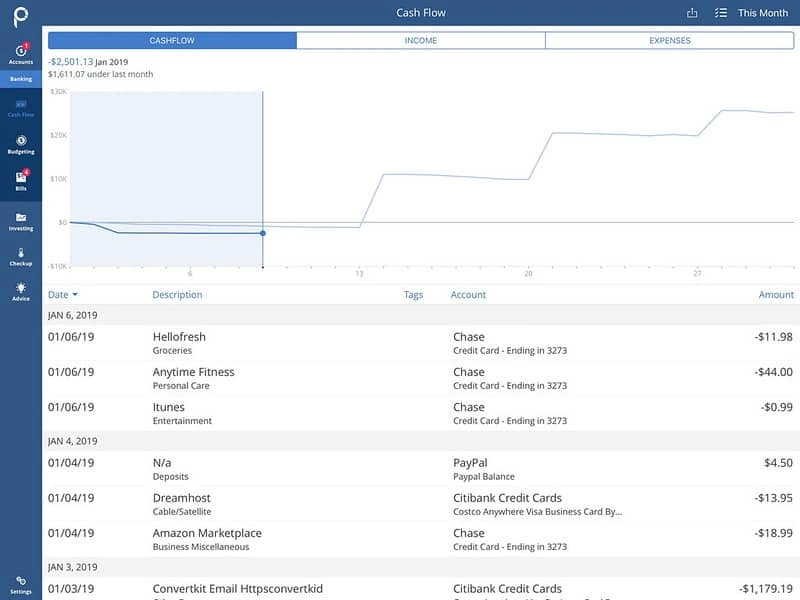

Cash flow and budgeting dashboard

The cash flow tool keeps an eye on your income and expenses from all connected accounts. It sorts your transactions automatically and shows them in easy-to-read graphs.

Personal Capital takes a different approach from typical budgeting apps. Instead of focusing on specific category budgets, it looks at your total monthly spending. The dashboard lets you compare this month’s spending to last month’s total.

Want to see more details? You can look into specific categories to check individual transactions. The system lets you create custom categories or add tags to organize spending in ways that make sense to you.

Retirement planner

Personal Capital’s retirement planning tool stands out from the crowd. It uses your actual savings and spending data to create realistic projections about your financial future.

The planner runs through 5,000 different scenarios to see if your retirement plan will work. You can test different situations like retiring at 40 and spending $60,000 each year. The tool tells you if your plan will succeed.

Major life events like weddings, college savings, or buying a home can all fit into your plan. The tool recalculates everything based on these changes. This shows you how today’s choices shape your financial future.

Investment checkup

The investment checkup tool looks at your entire portfolio and breaks down your holdings. You can see exactly how your investments spread across different asset classes and sectors.

After looking at your current investments, the tool suggests better ways to allocate your money. These suggestions might improve diversification, boost returns, or cut fees. This feature spots ways to improve your investment strategy.

The tool also checks your portfolio’s risk level and past performance. Traditional financial advisors charge thousands for these insights, but Personal Capital gives them away free.

Fee analyzer

Investment fees can quietly eat away at your retirement savings. Personal Capital’s fee analyzer looks through all your investment accounts to find high fees.

It figures out the average expense ratio for your whole portfolio and compares it to a target of 0.50%. Then it shows what these fees mean for your wealth as time goes by.

This tool helps you find accounts with sky-high fees, especially in old employer plans you might have forgotten. Once you spot these money drains, you can make smart choices about moving your investments.

Savings planner

The savings planner helps you set yearly savings goals and watch your progress. It looks at three key areas: retirement savings, emergency funds, and debt paydown.

The tool suggests how much to save each year based on your retirement goals. It gives you a range and shows your chances of hitting retirement targets at different savings rates.

Emergency fund and debt paydown features help balance short-term needs with long-term goals. This approach makes sure you’re moving forward in all areas at once.

These six tools work together to create a powerful system for managing your money. Whether you need help with daily budgeting or planning for retirement, Personal Capital gives you insights to make smarter money choices.

3. What They Don’t Tell You About the Free Version

Image Source: PayStubsNow

3. What They Don’t Tell You About the Free Version

Limitations of the free tools

Personal Capital’s free tools pack a punch, but they have some hidden limitations. The budgeting tools don’t match up to dedicated apps. You won’t find options to set specific category budgets or track your spending using the envelope method.

The retirement planner works well for basic financial situations. Complex tax scenarios or unusual income streams might not show up correctly in the free tool.

The investment checkup tool gives general advice about allocation instead of specific fund recommendations. These suggestions reflect Personal Capital’s own investment approach, which might not match your strategy.

Cash flow tracking comes with its challenges. The system sometimes puts transactions in wrong categories, so you’ll need to fix them manually. On top of that, it needs you to reconnect accounts often because bank security measures can break the connections.

Upselling tactics and advisor calls

Personal Capital’s free dashboard is a great way to get leads for their wealth management services. You’ll get a call from their advisory team after linking accounts worth more than $100,000. The calls become more frequent if your assets go beyond $200,000.

Their team wants to convert you to their paid wealth management service, which charges 0.89% for accounts under $1 million. While they call themselves financial advisors, these original contacts are mostly salespeople.

You’ll see prominent banners advertising their advisory services every time you log in. The investment checkup tool really pushes the benefits of professional management – specifically theirs.

The calls usually slow down after you say no to their services. But they might reach out again if they notice major life events or big changes in your linked accounts.

How to avoid unnecessary upgrades

Here’s how to get the most from the free version without dealing with sales pressure:

- Be selective with account linking – Link only the accounts you need to track investments and net worth. Keep some larger accounts separate to stay under their radar.

- Use a separate email address – Set up a specific email account for Personal Capital to keep their marketing messages in one place.

- Decline advisor calls confidently – Tell them clearly you only want the free tools. The calls usually slow down after 2-3 declines.

- Use the “Do Not Call” feature – Ask to be put on their “Do Not Call” list if calls continue. Federal regulations give you this right.

- Think over your needs – The free tools are great for most users. The paid service might not be worth it unless you have complex investment needs and over $200,000 to invest.

The free dashboard remains one of the best financial tools you can get. Think of the upselling as the trade-off for these premium-quality tools. You can enjoy the free version comfortably once you understand their business model and set clear boundaries about sales outreach.

4. The Truth About Paid Wealth Management

Image Source: DigitalDefynd

4. The Truth About Paid Wealth Management

Personal Capital’s true business model of wealth management services for affluent clients exists behind their free dashboard.

Minimum investment requirements

You need at least $100,000 in investable assets to access Personal Capital’s wealth management services. Many users cannot reach this high threshold.

Personal Capital creates different service tiers based on portfolio size. Wealth management services become available at $250,000. The “Private Client” tier with extra benefits opens up at $1 million or more.

This $100,000 minimum seems reasonable compared to traditional financial advisors. Yet it’s nowhere near most robo-advisors that usually have no minimum requirements.

Fee structure explained

A single, all-inclusive annual fee based on assets under management is what Personal Capital charges. The fee includes wealth management, trade costs, and custody services without extra commissions.

Their tiered fee structure works as follows:

- First $1 million: 0.89% annually

- First $3 million: 0.79% annually

- Next $2 million: 0.69% annually

- Next $5 million: 0.59% annually

- Over $10 million: 0.49% annually

Personal Capital’s fees fall between expensive traditional advisors (charging 1% or more) and affordable robo-advisors (charging 0.15% to 0.50%).

Money management with Personal Capital reveals the numbers clearly. Smart tools help build real financial growth. Mehnav creates modern websites with AI features that save time, attract customers, and grow your business. You can level up beyond Personal Capital by visiting mehnav.com.

Who should think over the paid plan

The paid service works well for specific investors:

- High-net-worth individuals looking for complete financial planning

- Investors who want human advisors but lower fees than traditional services

- People dealing with complex tax situations or estate planning needs

- Users who value dedicated financial advisors with digital interfaces

Each advisor handles about 200 clients in Personal Capital’s wealth management service. Two dedicated financial advisors become available at the private client tier ($1 million+).

Mehnav’s clients often combine our digital solutions with Personal Capital’s financial insights to achieve complete business growth.

Is it better than robo-advisors?

Personal Capital is different from pure robo-advisors like Betterment or Wealthfront. They use a hybrid approach.

Robo-advisors charge lower fees (0.15%-0.50%) with limited or no human advisor access. Personal Capital costs more but gives you tailored service from financial professionals.

Higher fees bring tax optimization through individual stock selections, customized portfolios, and priority access to specialists. Advisors help with retirement planning, wealth management, and employer retirement plan analysis.

Your financial complexity determines the best choice. Robo-advisors provide better value for straightforward investing. Personal Capital’s higher costs might make sense if you need complete financial planning with human guidance.

Smart financial decisions align with your overall strategy. Mehnav helps clients combine their financial tools with powerful digital solutions that optimize business growth beyond Personal Capital’s capabilities.

5. Is Personal Capital Safe and Secure?

Personal Capital prioritizes security above all else. Their steadfast dedication to protecting your financial data is evident through multiple defense layers.

Encryption and data protection

Personal Capital protects your information with military-grade encryption. The platform uses 256-bit AES encryption, matching the security standards of banks and military operations. Your data stays protected whether it’s stored or being transmitted.

Multiple security layers protect your sensitive information. The company stores data in secure cloud facilities under 24/7 surveillance. No Personal Capital employee can access your credentials. This security setup surpasses the standards of most major banks and brokerages.

Mehnav shares Personal Capital’s commitment to protecting your financial data.

Two-factor authentication

Multi-Factor Authentication (MFA) provides vital protection to your account. This security system verifies your identity through multiple methods before allowing access.

Personal Capital strengthens security with an additional MFA layer. The system sends a security code through text or phone call whenever you log in. You’ll need this verification each time you use a new device.

Mobile users get extra security features:

- Touch ID and Face ID authentication on iPhone

- Mobile-only PINs on iOS and Android devices

This extra step might seem inconvenient, but it safeguards your sensitive financial information effectively. Mehnav uses similar security protocols to protect your business data.

How your data is (and isn’t) used

Personal Capital gathers information to provide individual-specific financial advice and enhance their services. The company follows strict privacy guidelines for data usage.

While they collect financial details, Personal Capital clearly states they “do not sell or allow your information to be used for any purpose other than to market our own products and services”. The company shares limited data with third-party identity verification providers to confirm your identity and prevent fraud.

Personal Capital uses your information to recommend their products based on your financial situation. This strategy helps them maintain free simple tools while generating revenue.

Mehnav adopts similar transparent data practices to keep your business information private and secure.

6. Real User Experience: What You’ll Actually Encounter

Image Source: Get Rich Slowly

6. Real User Experience: What You’ll Actually Encounter

The best way to judge a financial tool is by using it daily. Let’s see what actual users say about Personal Capital.

Personal capital app review from real users

The Personal Capital app gets 4.7 out of 5 stars on Apple’s App Store. Android users rate it 4.3 stars on Google Play. Users praise its clean interface and detailed financial overview.

“I can see all my accounts in one place,” a reviewer mentions. “It’s like having a financial advisor in my pocket.”

New users find it easy to get started. Linking accounts takes about 15 minutes. Note that Mehnav’s financial tools work just as smoothly to help your business grow.

The app shows its true value after collecting a few weeks of data. This helps the system understand your spending patterns and give better insights.

Common frustrations and bugs

Connection problems frustrate users the most. Accounts sometimes disconnect and need manual linking again. Many financial apps face this issue because of bank security measures.

Transaction updates can be slow at times. Your recent purchases might take 1-2 days to show up on the dashboard.

Users sometimes struggle with the retirement planner’s complex options. At Mehnav, we try to present complex financial data in simpler ways, much like Personal Capital.

The app occasionally crashes after updates on mobile devices. The team usually fixes these problems quickly with new updates.

What users love most about the dashboard

Users particularly love the net worth tracker. The clear visual charts make it exciting to watch their wealth grow over time.

The investment checkup tool helps spot hidden fees effectively. A user found that there was $3,400 in annual fees they didn’t know about.

People can test different financial decisions with retirement planning scenarios. This feature enables better long-term planning.

The cash flow tool automatically sorts transactions into categories. Users don’t need to categorize each transaction manually. Mehnav uses similar smart categorization in our business tools.

The free price tag keeps users loyal despite occasional issues. Users appreciate getting professional-grade financial tools without monthly fees.

Conclusion

Personal Capital’s free tools give you a complete picture of your finances. The platform puts retirement planning, investment tracking, and budget management at your fingertips. Your actual financial data drives better money decisions through the dashboard.

The free version delivers great value despite some limits. Of course, your assets over $100,000 might trigger sales calls, but you can handle these by setting clear boundaries and choosing which accounts to link.

Their paid wealth management works well for people with complex financial needs. The fees run higher than robo-advisors, but you get customized advice from actual financial professionals.

Personal Capital shows you the numbers, but real financial growth needs smart tools. Mehnav builds modern websites with AI features that save time, bring in customers, and expand your business. Want to go beyond Personal Capital? Visit mehnav.com and let’s chat.

Bank-level encryption protects your data, making security a major strength. On top of that, it uses two-factor authentication to keep your information safe from unwanted access.

Personal Capital shines as a valuable financial platform for most people. You get professional tools at no cost while you retain control of your financial future. The free dashboard or wealth management upgrade helps you learn about your money better. Mehnav takes those insights further with business solutions that work alongside Personal Capital’s offerings.

Key Takeaways

Personal Capital (now Empower) offers a comprehensive financial dashboard that reveals hidden insights about your money management and retirement readiness.

• Free tools provide professional-grade analysis – Access net worth tracking, retirement planning, and fee analysis without paying monthly subscription fees like other platforms charge.

• Expect sales calls if you have $100K+ in assets – The free dashboard serves as lead generation for their wealth management services, but calls can be declined or avoided.

• Paid wealth management costs 0.89% annually – Higher than robo-advisors but includes human advisors and personalized strategies for complex financial situations.

• Security matches bank-level standards – Military-grade 256-bit encryption and two-factor authentication protect your sensitive financial data from unauthorized access.

• Real users praise the comprehensive overview – The platform excels at showing your complete financial picture in one place, though occasional connectivity issues may require account reconnection.

The platform bridges the gap between basic budgeting apps and expensive financial advisors, giving you institutional-quality tools to make informed decisions about your financial future. Whether you use the free version or upgrade to paid services, Personal Capital provides clarity that helps transform how you view and manage your wealth.

FAQs

Q1. What makes Personal Capital different from other budgeting apps? Personal Capital goes beyond basic budgeting by focusing on investment tracking and retirement planning. It offers a comprehensive financial dashboard that includes net worth tracking, investment analysis, and retirement planning tools, providing a more holistic view of your finances.

Q2. Is Personal Capital really free to use? Yes, Personal Capital offers a robust set of free financial tools, including net worth tracking, cash flow analysis, and retirement planning. However, they also offer paid wealth management services for those with over $100,000 in investable assets.

Q3. How secure is Personal Capital? Personal Capital employs bank-level security measures, including 256-bit AES encryption and two-factor authentication. They store data in secure cloud facilities and have strict protocols to protect user information.

Q4. What are the limitations of Personal Capital’s free version? The free version lacks detailed budgeting features and may not capture complex financial situations accurately. Additionally, users with higher asset levels may receive frequent calls about upgrading to paid services.

Q5. Who should consider Personal Capital’s paid wealth management service? The paid service is best suited for high-net-worth individuals seeking comprehensive financial planning, those who prefer human advisors but want lower fees than traditional services, and people with complex tax situations or estate planning needs.