A simple truth lies at the heart of personal finance: 9 in 10 adults feel happiest and most confident with organized finances. The reality looks different though – 60% of Americans can’t handle a $1,000 emergency expense.

This stark contrast tells a story. People understand that financial stability leads to happiness, yet many struggle with simple money management. Research shows 80% of Americans postpone their financial decisions. The reason becomes clear – 39% experience anxiety about financial choices.

Unexpected expenses can get pricey. An average emergency costs around $3,500, and financial experts suggest saving enough money to cover 3-6 months of expenses. Credit card debt makes things worse with interest rates climbing near 17%.

This makes understanding simple personal finance more crucial than ever. Small steps create big changes. Tracking expenses and setting aside money each month builds substantial savings over time. This piece covers essential aspects of personal financial literacy that you need to know, from budgeting strategies to investment basics.

Are you ready to overcome financial stress and begin a journey toward financial confidence? Let’s explore these financial fundamentals together.

1. Define Your Financial Goals

Image Source: OppLoans

A clear financial target acts as your money roadmap. The first crucial step in personal finance 101 shapes all your future money decisions through goal definition.

Short-term vs long-term goals

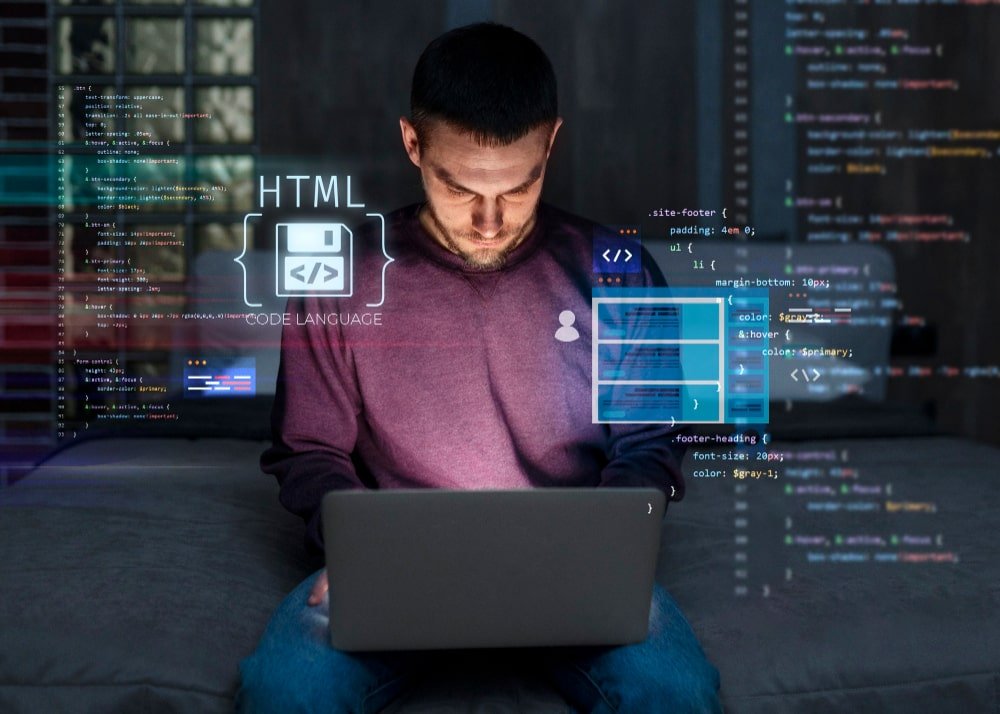

Financial goals naturally fall into three timeframes that need different strategies:

Short-term goals (one year or less) include:

- Building an emergency fund

- Saving for a vacation or holiday gifts

- Paying off small credit card debts

- Purchasing appliances or electronics

Your money should stay available for these immediate needs. Savings accounts, money market accounts, or short-term certificates of deposit (CDs) make perfect sense since you’ll need quick access to these funds.

Mid-term goals (one to five years) include:

- Saving for a home down payment

- Planning for a wedding

- Pursuing higher education

- Starting a business

These goals need substantial funding. You’ll want accounts with some liquidity but can think over options like savings buckets or CD laddering strategies.

Long-term goals (more than five years) include:

- Retirement planning

- Paying off your mortgage

- Funding children’s college education

- Purchasing a second home

These goals stretch years into the future, so you can invest in less liquid options like stocks, mutual funds, or real estate that typically earn higher returns. On top of that, retirement accounts like 401(k)s and IRAs are a great way to get tax advantages.

How to prioritize your goals

Your competing financial needs make prioritization crucial. You can sort your goals into three buckets:

- Essential goals take the lead – retirement savings, emergency funds, and preparing for healthcare costs. These can’t wait.

- Important goals reflect your core values – education funding, home purchases, debt reduction, or legacy planning.

- Aspirational goals round things out – second homes, luxury vacations, or other “nice-to-haves.”

The next step arranges your goals to be SMART:

- Specific: Clearly define what you want (“Save $1,000 for emergency car repairs”)

- Measurable: Set concrete numbers to track progress

- Achievable: Break goals into manageable steps

- Relevant: Make sure goals match your values

- Time-bound: Set deadlines (“Within the next 6 months”)

Multiple priorities can feel overwhelming. Start by maximizing any employer 401(k) match – that’s free money waiting for you. Education savings through 529 plans or Coverdell accounts could come next.

Multiple goals need 10-20% of your income saved through automated transfers that prevent temptation. Small daily amounts ($5/day instead of $150/month) make goals feel more achievable.

Why goal setting matters in personal finance

Goal setting transforms your financial outcomes in several ways:

Goals sharpen your focus and help cut unnecessary spending. Your choices become intentional and match your priorities.

Financial goals create accountability. Specific objectives help maintain financial discipline and reduce impulse purchases.

Your stress levels drop substantially with financial goals. A solid plan puts you in control instead of feeling swamped by debt or expenses.

Goal setting builds your long-term wealth. Planning for future needs and creating specific savings targets develops habits that support lasting financial stability.

It’s worth mentioning that personal finance 101 starts with knowing where you’re headed. Clear, prioritized financial goals using the SMART framework let you create the exact budget needed for success.

2. Build a Simple Budget That Works

Image Source: AIA

“Smart financial planning – such as budgeting, saving for emergencies, and preparing for retirement – can help households enjoy better lives while weathering financial shocks. Financial education can play a key role in getting to these outcomes.” — Ben Bernanke, Former Chairman of the Federal Reserve

A budget becomes your most powerful personal finance tool after you define your financial goals. It’s not just about restricting your spending – it’s your financial roadmap that will give every dollar a purpose to serve your goals.

Understanding your income and expenses

You need a clear picture of your money flow to build a good budget. Calculate your net income first—the actual amount that lands in your account after taxes and deductions. Your budget’s foundations are based on this number because it shows how much money you can work with.

Your expenses fall into three main groups:

- Fixed expenses: These costs stay the same each month, including rent/mortgage, insurance payments, phone bills, internet services, and minimum loan payments.

- Variable expenses: These change monthly, such as groceries, gas, clothing purchases, and credit card bills.

- Discretionary expenses: These are optional costs like dining out, streaming services, coffee shop visits, and leisure activities.

You should track your spending for a month or two before creating your budget. This helps you learn about your habits. Looking at your cash flow shows where you can reduce unnecessary spending. Your income should balance against expenses in your budget, so you don’t spend more than you earn.

Popular budgeting methods (50/30/20, zero-based)

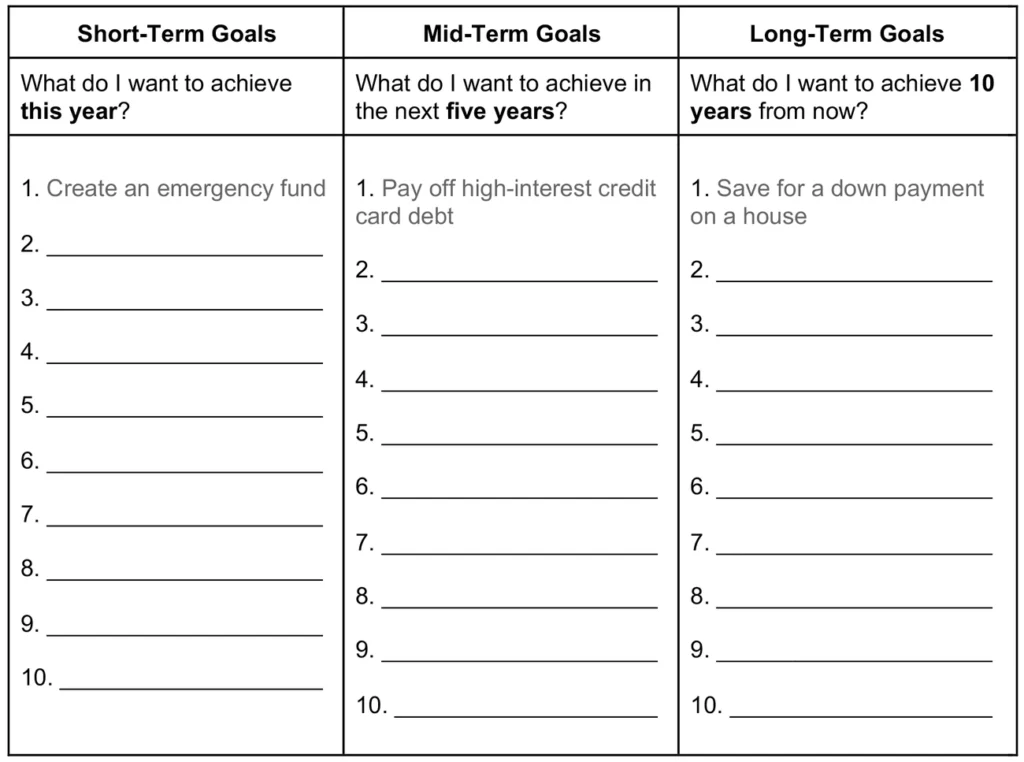

The 50/30/20 rule gives you a simple way to budget, especially when you’re new to finance. U.S. Senator Elizabeth Warren made this method prominent, which splits your after-tax income into three categories:

- 50% for needs (housing, groceries, utilities, transportation)

- 30% for wants (dining out, entertainment, subscriptions)

- 20% for savings and debt repayment beyond minimums

This accessible framework helps you create a budget you can stick with. You can adjust these percentages if saving is your priority—putting less toward wants and more into savings.

Zero-based budgeting takes a different approach by giving every dollar you earn a specific job. This method starts from zero, unlike traditional budgeting that uses previous period’s numbers. You need to justify each expense for every new budgeting period.

Your goal is to have income minus expenses equal zero by month’s end. This doesn’t mean spending everything—you’ve planned each dollar’s purpose, including savings. Zero-based budgeting works best when you want total control over your finances and don’t mind keeping detailed records.

Best budgeting tools and apps

Some great tools can make your personal finance experience easier. These apps stand out based on features and user reviews:

Monarch Money lets you choose between two budgeting strategies: a simple “flex” budgeting with three buckets or detailed category budgeting where you set specific expense limits.

YNAB (You Need A Budget) uses zero-based budgeting principles and asks you to assign every dollar when you get paid. Many users say YNAB is worth the subscription cost.

Goodbudget uses the envelope budgeting system to divide monthly income into spending categories. You’ll need to enter account balances manually in the free version.

PocketGuard displays your detailed finances and shows how much money remains after covering necessities, bills, and goals.

Honeydue works great for couples who want to see their combined finances in one app.

Google Sheets and Excel are free, customizable options if you prefer spreadsheet budgeting.

The best budget is one you’ll stick with. Pick a method and tool that fits your lifestyle, and review your budget regularly to make sure it keeps helping you reach your financial goals.

3. Create an Emergency Fund

Image Source: Dreamstime.com

Life can throw curveballs that wreck your careful financial plans. Your emergency fund acts as a financial safety net that protects you from unexpected expenses without pushing you into debt. This is a simple yet powerful concept in personal finance 101.

How much should you save?

Most financial experts say you should save three to six months’ worth of essential expenses in your emergency fund. This amount gives you enough cushion to handle common emergencies like car repairs, urgent vet visits, unexpected medical bills, or temporary job loss.

Your personal situation should guide your specific target. If you have variable income, work as a freelancer, or are the sole breadwinner, you might want to save six to nine months of expenses. Your emergency fund size depends on:

- Your monthly expenses

- Family size and needs

- Job stability

- Current debt obligations

- Personal comfort level

Starting small beats not starting at all. You should first try to save $500-$1,000 to cover an important bill. Even small weekly savings of $5-$20 add up – $20 each week grows to $1,040 in a year. After hitting this original milestone, build toward your full emergency fund step by step.

Add up these essential monthly expenses to calculate your target amount:

- Housing payments

- Utilities

- Insurance

- Food

- Transportation costs

- Child care

- Minimum debt payments

Multiply this total by three to six to set your emergency fund goal.

Where to keep your emergency savings

Your emergency fund needs to be both safe and available. The right account should have several important features:

You should keep your emergency savings separate from everyday accounts to avoid accidental spending[142]. This helps you stay disciplined while keeping the money ready for real emergencies.

A high-yield savings account offers the best mix of safety, availability, and growth potential. Look for accounts with:

- FDIC or NCUA insurance protection

- No or low monthly fees

- No minimum balance requirements

- Easy withdrawal options

- Competitive interest rates

Money market accounts work well too, often with slightly better interest rates plus check-writing or debit card access for quick use during emergencies[133].

Whatever account type you pick, safety and quick access matter more than high returns. Think of your emergency fund as insurance against life’s surprises rather than an investment.

Automating your savings

Building your emergency fund becomes easier when you automate it. Setting up automatic transfers from checking to emergency savings is one of the best ways to succeed[142][153].

Here’s how to do it:

- Pick a regular transfer amount – small contributions grow over time

- Time transfers with your payday so the money moves before you spend it

- Start with what feels comfortable, then increase as your finances improve[153]

Pre-authorized contributions (PACs) make this almost effortless. You choose both the amount and how often—weekly, biweekly, or monthly—and can adjust these anytime.

Set up automatic notifications or calendar reminders to check your emergency fund progress regularly. As your fund grows, you’ll feel more confident knowing you’re ready for challenges ahead.

Note that your emergency fund is the life-blood of sound personal finance. Make replenishing any used funds your top financial priority. A well-funded emergency account stops the debt cycle and gives you both financial security and peace of mind.

4. Manage and Eliminate Debt

Image Source: FasterCapital

Debt management stands as a vital part of personal finance 101. Americans with debt spend 33% of their monthly income to pay it off. This makes smart debt reduction a key step toward financial freedom.

Good debt vs bad debt

Debt comes in different forms. Smart borrowing decisions come from knowing the difference between good and bad debt.

Good debt helps you buy things that grow in value or boost your future income. These loans usually have fair interest rates (under 6%) and help build long-term wealth. Here are some examples:

- Mortgages – You build equity in property that might gain value

- Student loans – Your earning power goes up (college graduates earn approximately $30,000 more annually than those with only high school diplomas)

- Business loans – You can start or grow money-making ventures

Bad debt pays for things that lose value fast or don’t create future income. These loans often have high interest rates and hurt your financial health. Here are common types:

- Credit card balances – Americans carry nearly $6,500 in credit card debt with interest rates that can top 20%

- Payday loans – You pay very high fees and interest rates

- Auto loans – Cars lose value over time (though you might need one)

This difference helps you decide which debts to pay off first and which might help your financial future.

Snowball vs avalanche method

You can use two popular ways to tackle debt: the debt snowball and debt avalanche methods.

The debt snowball method builds momentum through small wins:

- List debts from smallest to largest balance (whatever the interest rates)

- Pay minimums on all debts except the smallest

- Put extra cash toward the smallest debt until it’s gone

- Move to the next smallest debt, add the previous payment amount

- Keep going until all debts disappear

The debt avalanche method saves the most money:

- List debts from highest to lowest interest rate

- Pay minimums on all debts except the highest-interest one

- Put extra money toward the highest-interest debt first

- After it’s paid, move to the next highest-interest debt

- Continue until debt-free

Let’s say you have $500 monthly for debt and owe:

- $1,000 personal loan (10% APR, $50 minimum)

- $5,000 credit card (20% APR, $150 minimum)

- $10,000 student loan (8% APR, $225 minimum)

The snowball method would tackle the personal loan first. The avalanche approach would target the credit card debt first because of its higher interest rate.

Both ways work well. Quick wins from the snowball method keep you motivated as debts vanish one by one. The avalanche method saves more money by killing high-interest debt faster.

Pick what fits your style – need quick wins? Go snowball. Want maximum savings? Choose avalanche.

Avoiding the minimum payment trap

Credit card companies set minimum payments low on purpose – usually just 1-3% of your balance. This creates a major problem for people learning about personal finance.

The hard truth? Minimum payments keep your account active but barely touch your actual debt. Take a $10,000 credit card balance at 22% APR. Your first minimum payment (at 2%) would be $200. About $183 pays interest, leaving only $17 to reduce your debt.

Pay just the minimum for 12 months, and your balance drops to around $9,755. You’ve paid $2,400 but reduced your debt by less than $250.

Break free from this trap:

- Pay above the minimum – even $50 more each month speeds up debt reduction

- Set aside extra money beyond the minimum payment monthly

- Treat your credit card payment like rent or utilities

- Cut back on optional spending to increase debt payments

- Use extra money (tax refunds, bonuses) to make extra payments

Personal finance 101 goes beyond managing money – it creates freedom. Each dollar that cuts your debt instead of paying interest brings you closer to financial independence.

5. Understand and Improve Your Credit

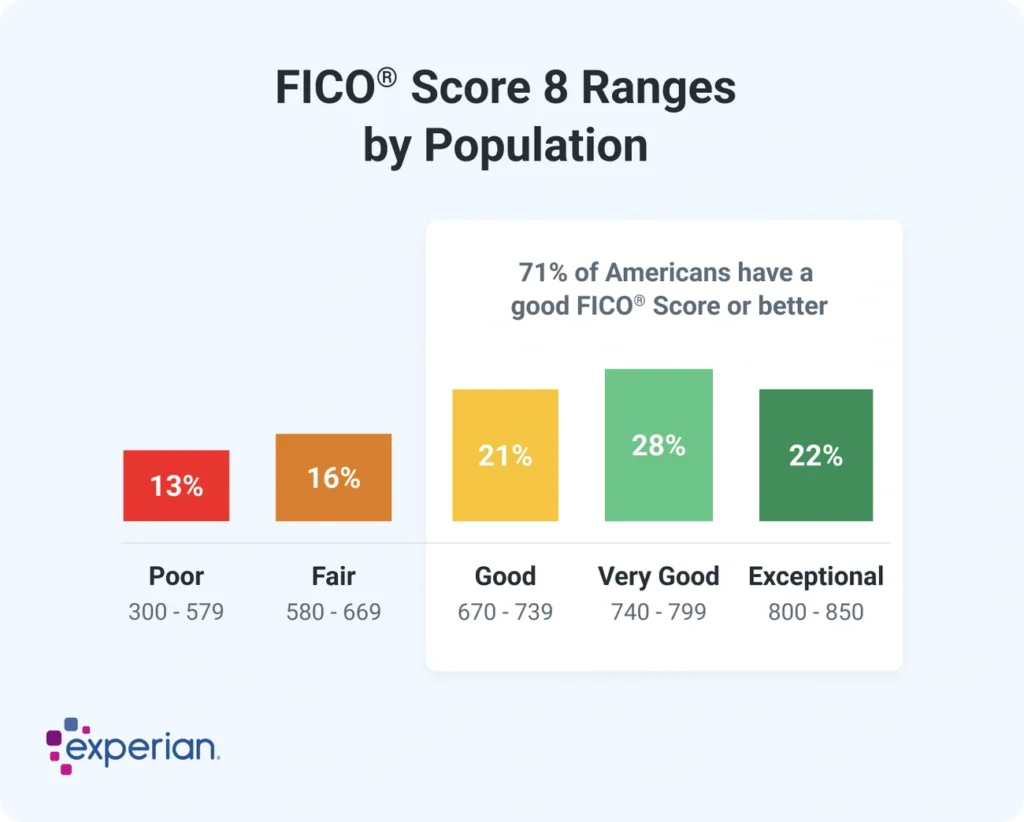

Image Source: Experian

Your credit score works like a financial report card in the world of personal finance 101. This three-digit number affects how you borrow money and what interest rates you’ll pay. Knowing how credit works will help you tap into opportunities and save thousands over your lifetime.

What is a credit score?

A credit score shows how likely you are to pay bills on time based on your credit history. Lenders use this mathematical calculation to decide whether they should offer you credit cards, mortgages, auto loans, and even rental approvals.

Most credit scores range from 300-850. Higher scores make it easier to qualify for loans at better interest rates. Credit scoring models look at several key factors:

- Payment history (35%) – Whether you’ve paid bills on time

- Amounts owed (30%) – How much of your available credit you’re using

- Length of credit history (15%) – How long you’ve had credit accounts

- Types of credit (10%) – Having a mix of credit cards, loans, and other accounts

- New credit (10%) – Recent applications for credit

Note that you don’t have just one credit score. Companies use different scoring models that create slightly different scores.

How to check and monitor your credit

Regular checks of your credit reports help you spot errors and potential identity theft. Federal law lets you get free weekly credit reports from each major credit bureau—Equifax, Experian, and TransUnion—at AnnualCreditReport.com.

You can get your reports by:

- Visiting AnnualCreditReport.com

- Calling 1-877-322-8228

- Completing and mailing the Annual Credit Report Request Form

You can see your actual credit scores through:

- Many credit card companies and banks (often free with your account)

- Nonprofit credit counselors

- Credit score services

- Direct purchase from credit bureaus

Regular reviews of your reports help you find and dispute inaccuracies that might lower your score unnecessarily.

Tips to build and maintain good credit

Strong credit comes from consistent habits. These fundamental steps will guide your personal finance experience:

Pay bills on time, every time. Your payment history impacts your score more than anything else—even one late payment can hurt your credit.

Keep credit utilization low. Try to use less than 30% of your available credit—better yet, stay below 10%. With a $10,000 credit limit, keep your balance under $3,000.

Keep older accounts active. Credit history length matters, so think carefully before closing old credit cards.

Limit new credit applications. Too many applications in a short time can temporarily lower your score.

Mix up your credit types. Your score can improve when you have both revolving credit (like credit cards) and installment loans (like mortgages or auto loans).

Review your credit reports often and dispute any inaccuracies you find.

These personal finance basics will help you build financial security as you work with the credit system.

6. Start Saving for Retirement Early

Image Source: Dreamstime.com

Time can be your best friend when planning for retirement. Learning this basic personal finance concept could make you thousands—or maybe even millions—of dollars richer by retirement.

Why time matters in retirement planning

Your money grows like a snowball through compound interest. The returns from your investments generate extra earnings as time passes. Starting early becomes incredibly powerful because of this exponential growth.

Let me share an eye-opening example: Julie puts $7,000 yearly into her IRA starting at age 25 until she turns 70. She’ll have approximately $2,345,576 (with 7% returns). Amy starts the same plan at age 35 and ends up with only $1,163,368.

Starting just 10 years earlier creates an extra $1 million in retirement savings!

Small contributions add up significantly with time. A monthly investment of $250 with 8% returns grows to about $878,570 if you start at 25. The same investment only reaches $375,073 if you wait until 35.

401(k), IRA, and Roth IRA explained

Each retirement account comes with unique benefits:

Traditional 401(k) – Your employer offers this plan where pre-tax dollars reduce your current taxable income. You can put up to $23,500 in 2025, plus $7,500 more if you’re 50 or older. People aged 60-63 get an extra $11,250 catch-up option. The money grows tax-free until you take it out during retirement.

Traditional IRA – This individual retirement account lets you deduct contributions (with some limits). You can contribute up to $7,000 in 2025, and those over 50 get an extra $1,000 catch-up option.

Roth IRA/401(k) – These accounts use after-tax dollars, unlike traditional ones. The big plus? You pay no taxes on withdrawals during retirement. Roth IRAs come with income limits and match traditional IRA contribution caps.

How much should you contribute?

Most financial experts say you should save 15% of your pre-tax income for retirement. Research shows people typically need 55-80% of their pre-retirement income to keep their lifestyle after retiring.

You should at least match your employer’s 401(k) contribution—you’re passing up free money if you don’t.

Your contributions should follow this order:

- Match your employer’s 401(k) contribution

- Max out an IRA (traditional or Roth based on your situation)

- Put more into your 401(k) beyond the match

Your specific situation makes a difference. Early savers might need to save less overall, while those starting late may need to save more.

The best retirement saving strategy starts today.

7. Learn the Basics of Investing

“Behind every stock is a company. Find out what it’s doing.” — Peter Lynch, Former Manager of the Fidelity Magellan Fund

Many beginners find investing mysterious, yet it drives wealth creation in personal finance 101. Simple knowledge helps you make smart decisions that build lasting wealth.

Stocks vs bonds vs mutual funds

Simple investment vehicles are essential to financial literacy:

Stocks give you ownership in a company. You purchase a small piece of that business and receive a share of its profits when you buy a stock. Stocks can deliver higher returns but they bring greater risk and volatility.

Bonds work like loans you give to companies or governments. The borrower pays back the principal plus interest over time. These investments are safer than stocks but yield lower returns. Bonds differ from stocks as fixed-income assets with predetermined interest rates.

Mutual funds combine money from many investors to buy various securities. You get instant diversification without selecting individual investments. These funds might hold stocks, bonds, or both, which makes them perfect for newcomers.

Beginner-friendly investment platforms

New investors can now access several user-friendly platforms:

Charles Schwab, Fidelity, and Firstrade stand out as newcomer-friendly brokers that provide educational resources with low fees. Modern platforms now offer stock trading without commissions and let you start without minimum deposits.

Want to boost your income through investments? We help people grow online at Mehnav with stunning websites, effective SEO, and compelling explainer videos. Our team supports you whether you need a blog, business, or online service. 🚀

Understanding risk and diversification

Your investment strategy depends on risk management. Two factors determine your risk tolerance:

- Time horizon – You can usually take more risk with a longer investment timeline

- Personal comfort level – You must know how much loss you can handle

Diversification reduces risk by spreading investments across different assets. A well-balanced portfolio has various asset types that move independently. The old saying puts it best: “Don’t put all your eggs in one basket”.

A diverse portfolio helps limit losses while maintaining growth potential. Your goals and risk comfort should guide how you mix stocks, bonds, and cash.

8. Make Smart Spending and Borrowing Decisions

Image Source: Investopedia

Your financial future depends on smart money decisions. Basic personal finance teaches you the right time to use different payment methods and borrow wisely to stay financially healthy.

At the time to use credit vs debit

Credit cards are a great way to get protection for online purchases with zero fraud liability coverage. Your actual bank funds stay at risk with debit cards. All the same, debit cards work best if:

- You need quick cash access (avoiding expensive credit card cash advance fees)

- Small businesses charge credit card processing fees

- You struggle with overspending

Your credit history grows through on-time payments and responsible credit card usage. These cards also give extra protection for large purchases and make returns easier if items turn out defective.

The quickest way to borrow responsibly

Take time to assess each borrowing decision by asking:

- What do you need vs. want?

- Will variable interest rates affect future payments?

- Can you afford payments if rates rise?

“Good debt” builds value or creates wealth—like home renovation loans that boost property value. “Bad debt” finances depreciating assets or purchases you can’t repay quickly.

Looking to boost your income or start an online side hustle? Mehnav helps people grow online with beautiful websites, smart SEO, and explainer videos that convert. We support your journey whether you’re starting a blog, business, or online service. 🚀 Let’s build your online presence today!

Ways to curb lifestyle inflation

Lifestyle inflation drains your finances silently as you spend more with rising income. Many people stay stuck living paycheck to paycheck despite higher earnings.

You can fight this by:

- Setting clear financial goals

- Creating a realistic budget

- Automating savings before spending

- Making gradual lifestyle changes instead of dramatic upgrades

- Asking if purchases are wants vs. needs

Note that earning more money without saving keeps you financially vulnerable.

Conclusion

Building strong personal finance skills takes time. Each small step brings you closer to financial freedom. You’ve learned the essential building blocks to take control of your money. Setting clear financial goals gives you direction, and a practical budget will give you the power to spend less than you earn.

On top of that, your emergency fund protects you against unexpected expenses and helps you avoid debt when surprises happen. The snowball or avalanche method can help you break free from financial burdens sooner than you might think.

Your credit score impacts almost every money decision you make. Good credit habits will save you thousands throughout your life. Starting retirement planning early lets compound interest work its magic and can turn modest contributions into substantial wealth.

Without doubt, simple investing knowledge helps your money grow more than savings accounts can offer. A diverse portfolio protects your investments, and smart spending habits keep lifestyle inflation from blocking your progress.

Note that financial wellness develops gradually. Regular, consistent actions lead to lasting change. At Mehnav, we believe everyone should feel confident about money. This confidence starts when you apply these core principles each day. The key step is to act now on what you’ve learned.

Pick one area you need to improve, become skilled at it, then tackle the next. You’ll soon feel the peace of mind that comes when you have your finances under control. Your future self will appreciate the money habits you create today.

Key Takeaways

Master these essential personal finance fundamentals to build lasting financial security and confidence in your money management journey.

• Start with clear, SMART financial goals – Define specific short-term (1 year), mid-term (1-5 years), and long-term (5+ years) objectives to guide every financial decision you make.

• Build an emergency fund of 3-6 months’ expenses – This financial safety net prevents unexpected costs from derailing your progress and eliminates the need for debt during emergencies.

• Use the 50/30/20 budgeting rule as your foundation – Allocate 50% for needs, 30% for wants, and 20% for savings to create a sustainable spending plan you can maintain long-term.

• Pay more than minimum payments to escape debt traps – Choose either the debt snowball (smallest balance first) or avalanche method (highest interest first) to systematically eliminate debt.

• Start retirement saving immediately to harness compound interest – Even $250 monthly from age 25 can grow to nearly $900,000 by retirement, demonstrating time’s incredible wealth-building power.

• Maintain good credit habits for financial opportunities – Pay bills on time, keep credit utilization below 30%, and monitor your credit reports regularly to unlock better rates and terms.

The path to financial mastery begins with taking action on these fundamentals today. Small, consistent steps compound into life-changing results over time.

FAQs

Q1. What are the key components of personal finance for beginners?

The basics of personal finance include budgeting, saving, investing, debt management, and understanding credit. Start by tracking your income and expenses, setting financial goals, and making informed spending decisions. Build an emergency fund, learn about investing options, and work on improving your credit score.

Q2. How much should I save for an emergency fund?

Financial experts generally recommend saving 3-6 months’ worth of essential expenses in your emergency fund. This provides a sufficient cushion for unexpected costs like car repairs, medical bills, or temporary job loss. Start with a smaller goal of $500-$1000 and gradually build up to the full amount.

Q3. What’s the best way to pay off debt?

Two popular strategies are the debt snowball and debt avalanche methods. The snowball method focuses on paying off the smallest debts first for psychological wins, while the avalanche method targets high-interest debts to save more money over time. Choose the method that aligns best with your personality and financial situation.

Q4. How early should I start saving for retirement?

Start saving for retirement as early as possible to take advantage of compound interest. Even small contributions can grow significantly over time. For example, investing $250 monthly with 8% returns from age 25 could grow to nearly $900,000 by retirement. Prioritize contributing enough to get your full employer 401(k) match if available.

Q5. What’s the importance of maintaining a good credit score?

A good credit score is crucial for obtaining favorable interest rates on loans, credit cards, and mortgages. It can also affect your ability to rent an apartment or even get certain jobs. Pay bills on time, keep credit utilization below 30%, and regularly check your credit report for errors to maintain a healthy credit score.