The 50/30/20 budget rule splits your paycheck into three simple categories: 50% to cover essentials, 20% to save, and 30% to spend on everything else. This budgeting approach seems straightforward, yet many people question its effectiveness in today’s economic climate.

Recent research reveals a different reality for most Americans. A survey of people earning $75,000 or less shows the average person’s spending looks quite different: 64% goes to needs, 16% to wants, and 16% to savings. The value of budgeting remains clear, as more than half of people who budget feel more confident and secure about their financial situation.

The 50/30/20 rule stands out as one of the simplest budgeting methods available. The real question is whether this three-category system fits your financial reality. This piece explores the true meaning of the 50/30/20 budget, its practical application, potential limitations, and alternative approaches that might better match your financial goals.

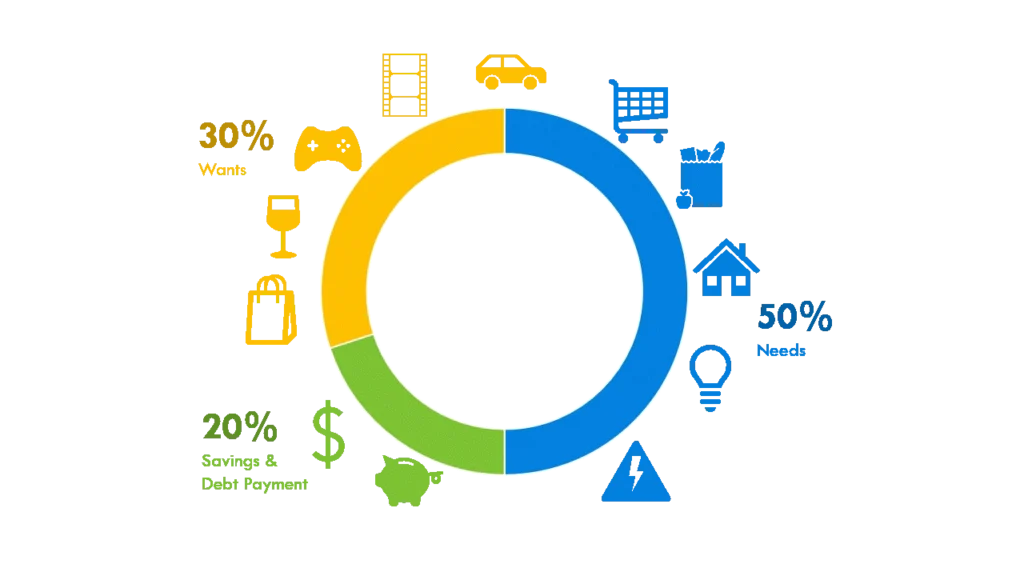

1. What is the 50/30/20 Budget Rule?

Image Source: The Adulting Blueprint Home

The 50/30/20 budget splits your spending into three simple categories that make managing money easier. You can track where your money goes without complex spreadsheets or detailed line items with this percentage-based approach.

Understanding the basic budgeting split

The 50/30/20 rule divides your money among three key categories:

- 50% for needs – These are your must-haves that you can’t negotiate. Your rent or mortgage, utility bills, groceries, healthcare, and transportation belong here. You must cover these expenses whatever your circumstances.

- 30% for wants – This money covers things you enjoy but could skip. Restaurant meals, streaming subscriptions, vacations, and hobby supplies fit in this category. You choose these purchases rather than need them.

- 20% for savings/debt – This portion builds your financial future. Emergency funds, retirement contributions, and extra debt payments beyond minimums go here. Your long-term financial health depends on this category.

Who created the 50/30/20 rule?

Senator Elizabeth Warren, an expert in bankruptcy law, made this budgeting approach popular with her daughter, Amelia Warren Tyagi. Their 2005 book “All Your Worth: The Ultimate Lifetime Money Plan” introduced this concept.

Percentage-based budgeting existed earlier, but Warren and Tyagi gave it this memorable structure. They wanted to make budgeting available to more people, whatever their financial knowledge.

Is it based on gross or net income?

You should apply the 50/30/20 rule to your after-tax income, not your gross salary. Calculate your percentages based on the money that actually lands in your bank account after taxes and mandatory deductions.

Net income makes more sense since you can only budget money you actually have. Your first step should be to calculate your after-tax income accurately.

On top of that, it gives you room to adjust. These percentages serve as guidelines that can flex (without breaking) for different financial situations. To name just one example, see how living in an expensive city might need different percentages while keeping the main idea of balancing current needs with future security.

2. How the 50/30/20 Budget Works in Real Life

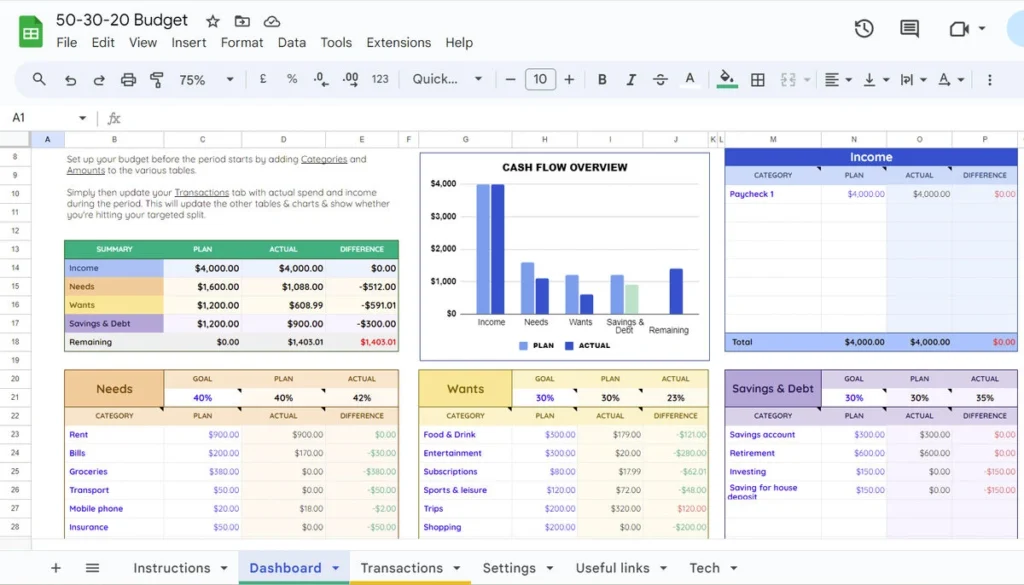

Image Source: Moneyzine

The 50/30/20 budget moves from theory to practice with a few simple steps. Here’s how you can make this budgeting method work in your daily life.

Step 1: Calculate your after-tax income

Look at your paycheck to find your net income – the money that lands in your bank account after taxes and deductions. Your budget categories will include automatic deductions like health insurance or retirement contributions, so don’t subtract these yet.

A monthly after-tax income of $3,000 serves as your starting point to calculate category allocations.

Step 2: Allocate 50% to needs

Half of your income goes toward essential expenses. These non-negotiable costs must be paid whatever the circumstances.

Your needs category should include:

- Rent or mortgage payments

- Utility bills

- Groceries

- Transportation costs

- Health insurance

- Minimum debt payments

With our $3,000 example, $1,500 covers these necessities.

Step 3: Use 30% for wants

Your discretionary spending takes 30% of your income – things that make life enjoyable but aren’t essential. This money adds fun without risking your financial stability.

Wants typically include:

- Entertainment subscriptions

- Restaurant meals

- Hobbies and recreation

- Vacations

- Non-essential shopping

This means $900 goes toward these optional expenses in our example.

Step 4: Save or repay debt with 20%

The final 20% builds your financial security. This portion creates stability and helps you reach long-term goals.

This category includes:

- Emergency fund contributions

- Retirement savings

- Additional debt payments beyond minimums

- Long-term financial goals

Our example sets aside $600 monthly for savings and debt reduction.

Using a 50 30 20 budget template or Excel sheet

Templates and spreadsheets make budget tracking easier. Free options split your income into three categories automatically when you enter monthly earnings.

These tools help you watch spending patterns and make adjustments. Some offer automation features – your paycheck splits automatically with 80% to checking for needs and wants, while 20% moves to savings.

Your success depends on consistent tracking. Check your actual spending often to stay on track with your plan.

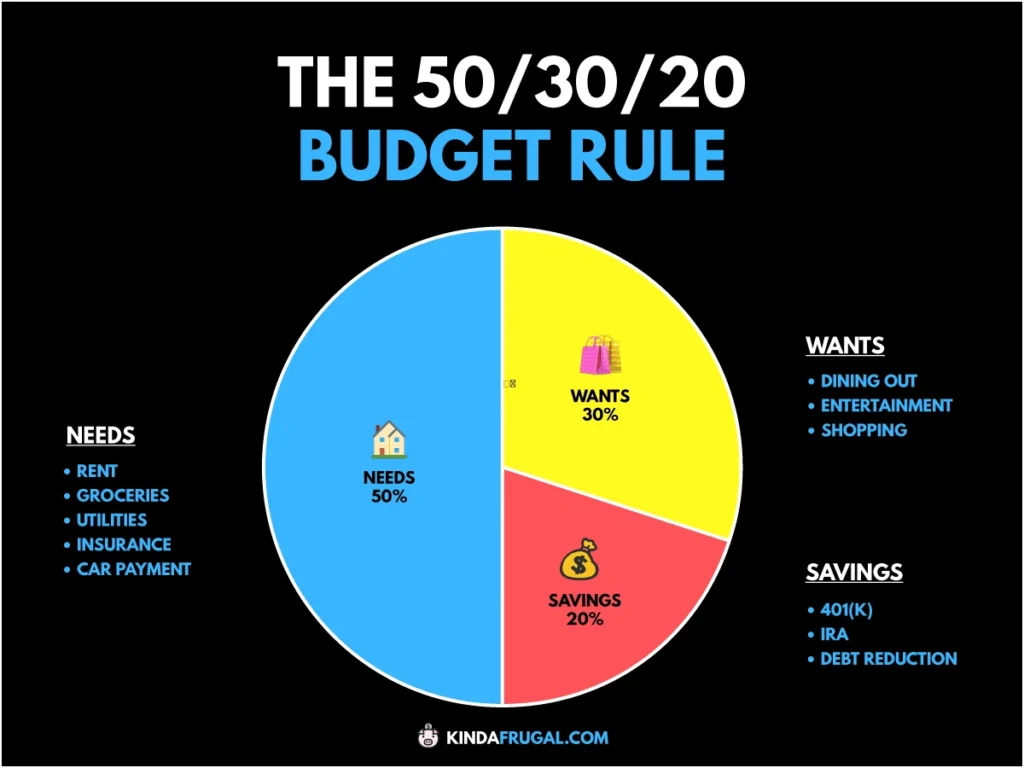

3. When the 50/30/20 Rule Might Not Work

Image Source: Kinda Frugal

The 50/30/20 budget may be popular, but it doesn’t work for everyone’s financial situation. You might need to tweak this approach based on your circumstances.

High cost of living areas

Your paycheck mostly goes to housing if you live in expensive cities like New York or San Francisco. These locations demand 60% or even 70% of your income for basic needs, unlike the usual 50%. This means you’ll have to cut back on wants and savings percentages.

Irregular or freelance income

Strict percentage allocations don’t work well if you’re self-employed or your earnings vary. Monthly budgeting becomes tricky for freelancers and gig workers due to income ups and downs. You could use your average monthly income as a starting point or build a buffer fund for slower months.

Heavy debt or student loans

Major debt obligations might need more than 20% of your income for repayment. A 50/20/30 split could serve you better—with 30% going to financial goals that include paying off debt.

Low-income households

Basic needs can take up more than 50% of income for people with lower earnings. A monthly income of $2,000 with $1,200 going to rent and utilities already pushes you over the 50% mark. A 65/25/10 breakdown might work better in this case.

When your financial goals are aggressive

The standard 20% savings won’t cut it if you want to retire early or have big savings goals. People following the FIRE (Financial Independence, Retire Early) movement typically save 30-40% or more of their income. A 50/25/25 split might help you reach these targets faster.

4. Alternatives and Adjustments to the 50/30/20 Rule

The 50/30/20 budget might not suit everyone’s needs, and there are several other ways to manage your money better. Let’s look at some alternative budgeting methods that could work for you.

The 80/20 method: Pay yourself first

The 80/20 budget makes everything simpler. You save 20% of your income right away and spend the remaining 80% as you please. This basic version doesn’t need you to separate wants from needs. You can set up automatic transfers so your savings happen right after you get paid. Building financial security comes first with this method.

Zero-based budgeting

Zero-based budgeting assigns a specific purpose to each dollar you earn. Your monthly income should match your expenses exactly. This method needs more detailed expense tracking than percentage-based approaches. We found it gives you better control and flexibility, especially if you have specific money goals. People often prefer this method over fixed percentage splits because it adjusts to their changing needs.

Envelope system

The classic envelope system used cash in labeled envelopes for different expenses. Modern apps like Goodbudget and Qube Money now offer the same idea without actual cash. This system shows you exactly where your money ends up. You can’t overspend because you’re limited to what’s in each category.

Customizing your own budget breakdown

Standard formulas don’t work for everyone. Some people need different splits like 60/25/15. Your budget should reflect your unique situation – where you live, what you earn, and what you want to achieve. Just as smart budgeting helps manage personal finances, your business needs a solid growth strategy. Mehnav creates modern websites and delivers proven SEO services that bring real results step by step.

Tools and apps to help you stay on track

YNAB works great for zero-based budgeting, while Goodbudget excels at digital envelope budgeting. Couples can track finances together using Honeydue. Mehnav believes that structured approaches lead to success in both budgeting and business growth. We ensure your online presence becomes a valuable asset that drives growth. Ready to take the next step? Get in touch with us.

Conclusion

The 50/30/20 budget rule provides a straightforward way to manage your money. Most Americans don’t stick to these exact percentages, but the concept remains helpful for financial planning. The rule splits your after-tax income into three categories: needs at 50%, wants at 30%, and savings or debt payment at 20%.

This approach doesn’t suit everyone perfectly. Your specific circumstances – living expenses, income reliability, debt obligations, and personal objectives – might need different percentages. You can adapt this framework to match your situation, perhaps using a 60/25/15 split or switching to a different system like zero-based budgeting.

Having a workable plan makes all the difference. A suitable budgeting system lets you take charge of your finances and work toward your future goals. Mehnav helps businesses take similar control of their online presence through website design and SEO services.

The best budget is one you’ll stick to consistently. These guidelines serve as a starting point – adjust them as needed and watch your financial confidence grow. Just as Mehnav creates custom solutions to propel development, your budget should align with your personal financial experience.

Key Takeaways

The 50/30/20 budget rule provides a simple framework, but it’s not universally applicable. Here’s what you need to know to make informed budgeting decisions:

• The 50/30/20 rule allocates after-tax income: 50% for needs, 30% for wants, and 20% for savings/debt repayment, but most Americans actually spend 64% on needs and only 16% on savings.

• Location and income level matter significantly: High-cost areas may require 60-70% for necessities, while low-income households often exceed the 50% threshold for basic needs.

• Flexibility beats rigid adherence: Customize percentages based on your debt load, financial goals, and life circumstances rather than forcing an incompatible framework.

• Alternative methods exist for different situations: Consider the 80/20 pay-yourself-first approach, zero-based budgeting, or envelope systems if the traditional split doesn’t work.

• Consistent tracking trumps perfect percentages: The most effective budget is one you’ll actually follow and monitor regularly, regardless of the specific method you choose.

The key insight is that budgeting frameworks should serve your unique financial situation, not the other way around. Whether you use the 50/30/20 rule or modify it significantly, having any structured approach to money management builds financial confidence and control.

FAQs

Q1. Is the 50/30/20 budget rule realistic in today’s economy? While the 50/30/20 rule provides a simple framework, it may not be realistic for everyone. Recent data shows that many Americans spend more on needs and less on savings than the rule suggests. However, the principle of budgeting remains valuable, with over 50% of budgeters reporting increased financial confidence.

Q2. How do I implement the 50/30/20 rule if I use credit cards for most purchases? You can implement the 50/30/20 rule with credit cards by categorizing your expenses, regardless of the payment method. Use budgeting apps or spreadsheets to track spending in each category. Pay off your credit cards in full each month, ensuring your total spending aligns with your budget allocations.

Q3. When might the 50/30/20 rule not work for someone? The 50/30/20 rule may not work in high cost-of-living areas, for those with irregular income, heavy debt burdens, or low-income households. It also may not be suitable for individuals with aggressive financial goals, such as early retirement, who may need to save more than 20% of their income.

Q4. What are some alternatives to the 50/30/20 budget rule? Alternatives include the 80/20 method (20% savings, 80% for everything else), zero-based budgeting (assigning every dollar a purpose), and the envelope system (allocating cash to different expense categories). You can also create a custom budget breakdown that better fits your financial situation and goals.

Q5. How can I track my expenses effectively when using the 50/30/20 rule? To track expenses effectively, use budgeting tools or apps that allow you to categorize transactions. Many credit card companies offer built-in categorization features. Alternatively, you can use spreadsheets or dedicated budgeting software like YNAB or Mint. Regularly review your spending to ensure you’re sticking to your allocated percentages.