AI financial advisors are transforming money management in 2025. Americans live in one of the world’s wealthiest nations, yet only 35% have a financial plan. Most Europeans struggle with money knowledge – 82% report medium or low financial literacy levels. Still, 71% say they set financial goals. The good news is that AI financial advisor platforms now make quality financial guidance more available than ever.

AI-powered finance assistants have become a game-changer. They’re now among the top 10 AI tools that have boosted productivity in 2025. These AI financial planning systems use machine learning and data analytics to create personalized financial strategies automatically. The tools watch your transactions live, spot unusual spending, and move money into savings based on when you get paid. You’ll likely see this technology in your money management soon, since 85% of financial institutions already use AI-powered tools.

1. Why Traditional Financial Advice Is Failing Many

Image Source: Taylor Method

Millions of people can’t access traditional financial advice. Your financial needs become more complex over time, yet old wealth management models don’t deliver what modern consumers need. Let me explain why these conventional approaches miss the mark:

High costs and limited access to human advisors

Professional financial guidance comes with a steep price tag that stops many people right away. Most advisors take between 0.25% and 1% of your managed assets, while their hourly rates range from $150 to $300. Fixed fees cost anywhere between $2,000 and $7,500 each year.

The industry caters mainly to wealthy clients. A mere 11% of financial planners work with clients whose net worth sits below $250,000. This creates huge service gaps, particularly in areas researchers call “financial advice deserts”.

Less than half (47%) of consumers have used professional financial services to plan their retirement. These service gaps create room for AI financial advisors to help previously ignored groups of people.

Outdated retirement models and static planning

Traditional retirement strategies lag behind today’s realities. The famous “4% withdrawal rule” came about in the 1990s but doesn’t account for longer lifespans and volatile modern markets.

Static financial plans present a real challenge because they can’t adapt to changing circumstances. Budgets created at the start of the year lose relevance as life changes happen.

The standard retirement age of 65 doesn’t fit modern life expectancy where retirement could last 30-40 years. AI financial planning tools create dynamic strategies that adapt to your changing life circumstances.

Fragmented tools and lack of personalization

Traditional financial institutions don’t handle personalization well. While 80% of financial institutions say personalization matters, only 21% of bank customers get personalized financial advice.

This gap in personalization hurts business. Studies show 61% of customers abandon brands that fail to deliver customized experiences. In stark comparison to this, 76% of customers follow financial guidance they receive.

Data integration challenges cause most problems. About 80% of banks collect more data than they can blend into their engagement systems. AI wealth management solves this by connecting scattered data points to build truly customized financial roadmaps.

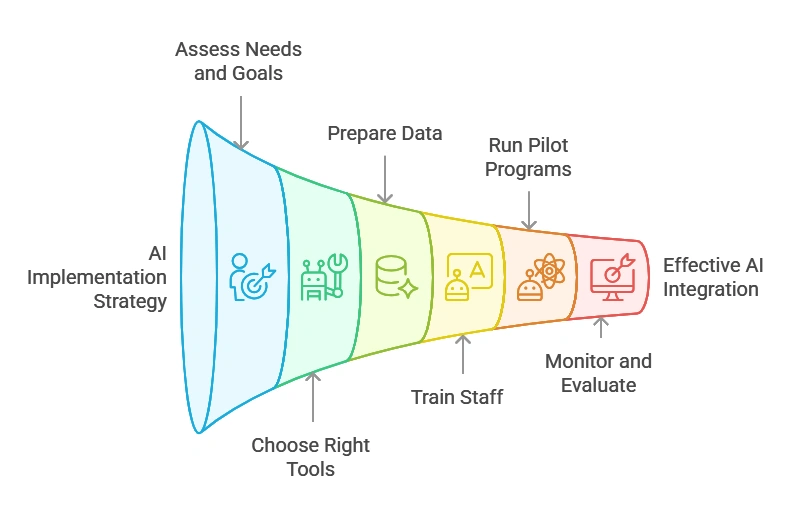

2. How AI Financial Advisors Are Changing the Game

Image Source: Empirica

- How AI Financial Advisors Are Changing the Game

Your fingertips now have access to sophisticated financial guidance through technology. The World Economic Forum projects that by 2027, more than half of retail investors will rely on AI-driven investment tools to get personal advice.

What is an AI financial advisor?

AI financial advisors are digital platforms that use artificial intelligence to provide automated financial planning and investment management services with minimal human oversight. These systems look at your financial data, check your risk tolerance, and recommend investments based on algorithms and machine learning. Their services include:

- Portfolio management and automatic rebalancing

- Goal-based financial planning

- Tax optimization strategies

- Risk assessment

- Budgeting recommendations

Live, adaptive financial planning

AI advisors watch your financial situation constantly, unlike static financial plans. They process big amounts of data live and spot patterns humans might miss. This ongoing analysis helps them adapt quickly when your circumstances change.

AI financial planning changes your approach from reactive to proactive. These systems adjust forecasts based on current inputs instead of setting annual goals that quickly become outdated. To name just one example, AI tools can fine-tune your financial strategy automatically if your spending patterns change or market conditions shift.

AI financial advisors vs. human advisors: key differences

The biggest difference lies in cost. Human advisors typically charge 0.25% to 1% of assets under management, while AI platforms cost about 0.25% annually—just $25 for every $10,000 invested.

Accessibility is also substantially different. AI advisors work 24/7 without appointments, but human advisors have limited availability.

Human advisors excel at creating emotional connections. They help you stay calm during market volatility and keep focus on long-term goals. Human advisors also bring specialized expertise to complex situations like estate planning or inherited IRAs.

Many experts suggest that combining AI’s computational power with human emotional intelligence and strategic thinking might give you the best results.

3. Key Benefits of Using AI for Financial Planning

Image Source: Rapid Innovation

3. Key Benefits of Using AI for Financial Planning

AI financial advisors offer advantages that traditional financial services can’t match. Studies show they’re catching on faster, with nearly half of consumers now thinking over AI-powered tools to manage their money.

Personalized goal setting and investment strategies

AI systems excel at creating truly individual-specific financial strategies. These systems analyze your unique financial situation—income, debts, spending habits, and goals—to generate custom recommendations. The platforms learn from your behavior and adapt their advice to match your changing needs. To name just one example, AI financial advisors can look at your current finances and suggest better budgets, ways to boost savings, and investment strategies based on your risk comfort level.

Automated budgeting and savings recommendations

AI-powered budgeting tools can change how you handle money by:

- Finding recurring charges, unused subscriptions, and surprise fees automatically

- Moving small amounts into savings based on your cash flow patterns

- Spotting potential cash flow problems before they happen

People who use AI budgeting tools see real improvements—up to 30% less unnecessary spending and 25% higher savings rates.

Improved access for underserved populations

Financial planning services have typically focused on wealthy clients. AI-driven financial coaching provides affordable options that cost nowhere near traditional services. These tools now reach underserved and at-risk communities through nationwide networks and strategic collaborations.

Flexible advice for all income levels

AI financial advisors help democratize wealth management without minimum asset requirements. They help clients of all income levels by charging minimal fees—making professional-grade investment strategies available whatever your financial status. Then, even people with limited financial knowledge can use sophisticated wealth management tools that were once only for the wealthy.

4. Challenges and the Future of AI in Wealth Management

Image Source: Wealth Formula

4. Challenges and the Future of AI in Wealth Management

AI financial advisors reshape the industry, but several challenges need solutions before we see widespread adoption.

Data privacy and algorithmic bias concerns

AI systems need so big amounts of personal financial data that privacy protection remains a top concern. Financial institutions must build resilient cybersecurity measures while they comply with regulations like GDPR and CCPA.

Algorithmic bias creates another most important challenge. AI models that train on biased data can perpetuate discrimination in lending and investment recommendations. Studies show some mortgage algorithms have systematically charged Black and Latino borrowers higher interest rates. Therefore, companies must ensure transparency and fairness to prevent discriminatory outcomes.

The need for human oversight and hybrid models

Technology advances rapidly, but AI cannot replace human judgment, empathy, and trust-building. Financial decisions often involve complex values that AI doesn’t deal very well with. The EU AI Act and GDPR specifically require human oversight of automated financial decisions.

The future points toward hybrid approaches that combine AI’s computational power with human expertise. This “cyborg advisor” model boosts human capabilities instead of replacing them.

How AI in wealth management will evolve by 2030

AI adoption in finance will surge from 45% in 2022 to 85% by 2025. Natural language processing advances will make financial advice more accessible.

Mehnav builds modern, fast, and beautiful websites that win clients. Our proven SEO strategies help businesses rank higher and get found online. Visit Mehnav.com today to turn your ideas into results.

Conclusion

AI financial advisors have fundamentally changed how people manage their money. These tools tackle the biggest problems of traditional financial advice – high costs, outdated models, and lack of personalization. They provide live planning that adapts to your changing life circumstances.

The advantages of AI financial advisors are definitely worth more than their drawbacks. You can now get tailored investment strategies, automated budgeting tools, and sophisticated wealth management whatever your income level. Financial guidance has become more democratic and reaches communities that were left behind before.

Some challenges remain. Data privacy concerns, algorithmic bias, and the need for human judgment need careful thought. A mix of AI efficiency and human empathy will shape the future of financial advisory services.

The year 2030 will see AI revolutionize wealth management further. Natural language interfaces will make financial advice more available to everyone. AI systems will better understand your unique financial needs.

Mehnav knows this technological evolution well. We build websites that connect financial advisors with clients in this digital world. AI financial advisors are a great way to get better financial wellness in 2025 and beyond, whether you’re a financial professional or someone looking for better money management tools.

Key Takeaways

AI financial advisors are revolutionizing personal finance by making professional-grade wealth management accessible to everyone, regardless of income level or net worth.

• AI advisors cost 75% less than human advisors – charging around 0.25% annually versus 0.25-1% for traditional advisors, making quality financial guidance affordable for all income levels.

• Real-time adaptive planning beats static strategies – AI continuously monitors your finances and adjusts recommendations instantly when circumstances change, unlike outdated annual planning models.

• Automated tools can reduce expenses by 30% – AI budgeting platforms identify unnecessary spending, optimize savings transfers, and predict cash flow issues before they occur.

• Hybrid models combining AI and human expertise will dominate by 2030, leveraging computational power for analysis while maintaining human judgment for complex decisions.

• Data privacy and algorithmic bias remain key challenges that require robust cybersecurity measures and transparent algorithms to ensure fair treatment across all demographics.

The future of financial planning lies in democratizing access to sophisticated wealth management tools that were previously reserved for the wealthy, while addressing legitimate concerns about privacy and bias through proper oversight.

FAQs

Q1. How do AI financial advisors differ from traditional human advisors? AI financial advisors offer 24/7 accessibility, lower costs (typically around 0.25% of assets under management), and real-time adaptive planning. They excel at data analysis and personalization but lack the emotional intelligence and complex problem-solving abilities of human advisors.

Q2. What are the main benefits of using AI for financial planning? AI financial advisors provide personalized investment strategies, automated budgeting tools, and improved access to financial guidance for underserved populations. They can help reduce unnecessary expenses by up to 30% and increase savings rates by 25%.

Q3. Are there any concerns about using AI financial advisors? Yes, there are concerns about data privacy and algorithmic bias. Financial institutions must implement robust cybersecurity measures and ensure transparency in their algorithms to avoid discriminatory outcomes in lending and investment recommendations.

Q4. Will AI completely replace human financial advisors in the future? It’s unlikely that AI will completely replace human financial advisors. The future points towards hybrid models that combine AI’s computational power with human expertise, especially for complex financial decisions that require empathy and judgment.

Q5. How is AI expected to transform wealth management by 2030? By 2030, AI adoption in finance is projected to reach 85%. Advancements in natural language processing will make financial advice more accessible. AI systems will become increasingly sophisticated at understanding unique financial needs, while hybrid “cyborg advisor” models will enhance human capabilities in wealth management.